Lithuanian Fintech’s Growth Momentum Continued in 2022 Despite Market Conditions

by Fintechnews Baltic March 15, 2023Despite turbulent market conditions, the Lithuanian fintech sector demonstrated resilience in 2022, recording strong revenue growth and sustained startup funding activity, new data from Invest Lithuania, the country’s agency for foreign direct investment and business development, show.

The Fintech Landscape in Lithuania 2022-2023 report, released earlier this month, provides an overview of the Lithuanian fintech industry, sharing the latest trends emerging in the sector and presenting the latest data, success stories, and market expectations for what is coming next in the sector.

According to the report, though 2022 was a trying year for the Lithuanian fintech sector, marked by Russia’s invasion of Ukraine and unforeseen challenges, the industry continued its growth momentum against all expectations.

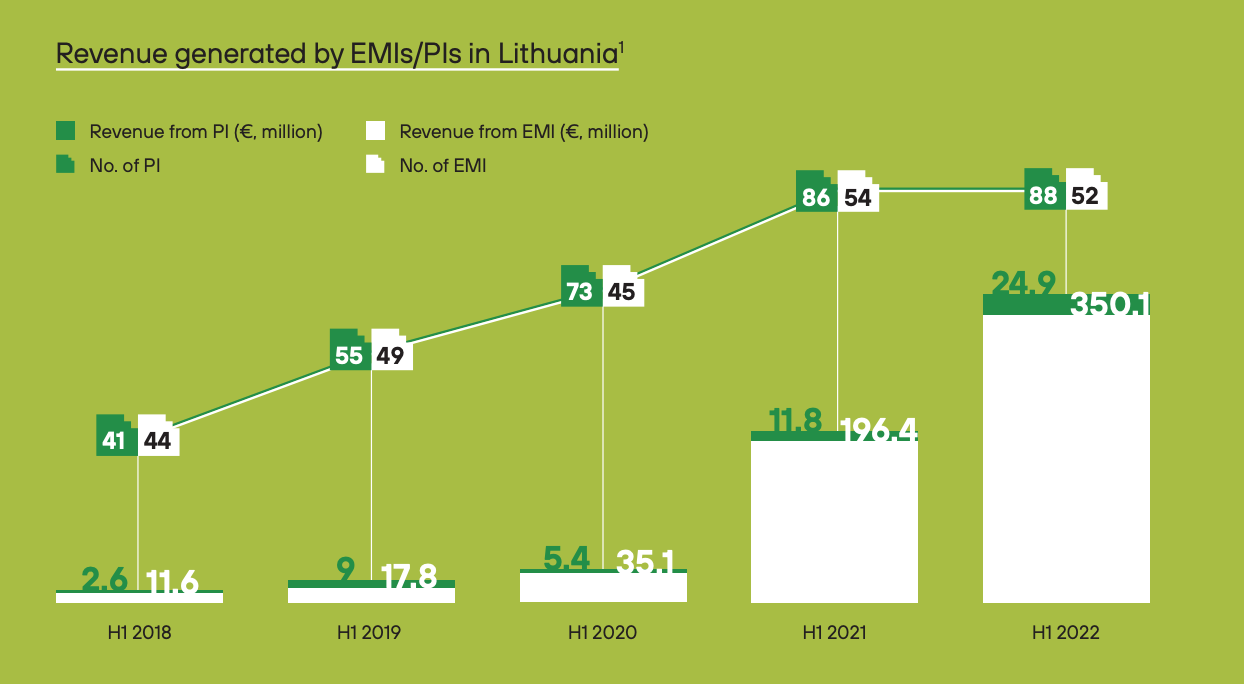

In H1 2022, the revenue generated by licensed electronic money and payment institutions reached a new record of EUR 375 million, up 80% year-on-year (YoY), the data show. Compared with H1 2018, the sum represents a 26 times increase, a growth that was manly driven by larger and more established fintech companies, which saw their revenue increase, by more than 100% during the four year period, in some cases, the report notes.

Revenue generated by EMIs/PIs in Lithuania, Source: Fintech Landscape in Lithuania 2022-2023, Invest Lithuania, March 2023

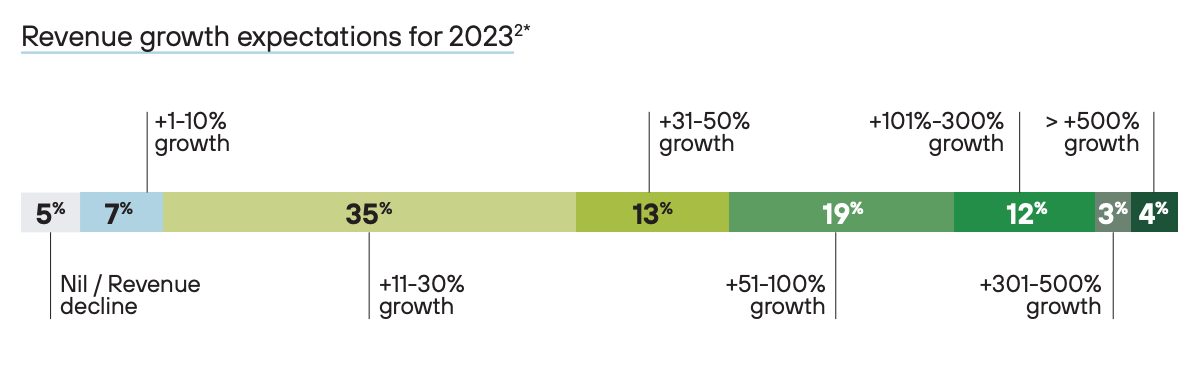

Amid the tremendous growth observed in 2022, fintech companies based in Lithuania have an optimistic outlook for their sector this year.

A survey of 93 fintech companies in the country conducted as part of the report found that 94% of all the companies polled are expecting their revenues to grow in 2023. While the majority of respondents (35%) expect their revenues to increase at a sustainable rate of 11% to 30%, a significant 19% are anticipating to more than double their revenues this year.

Revenue growth expectations for 2023, Source: Fintech Landscape in Lithuania 2022-2023, Invest Lithuania, March 2023

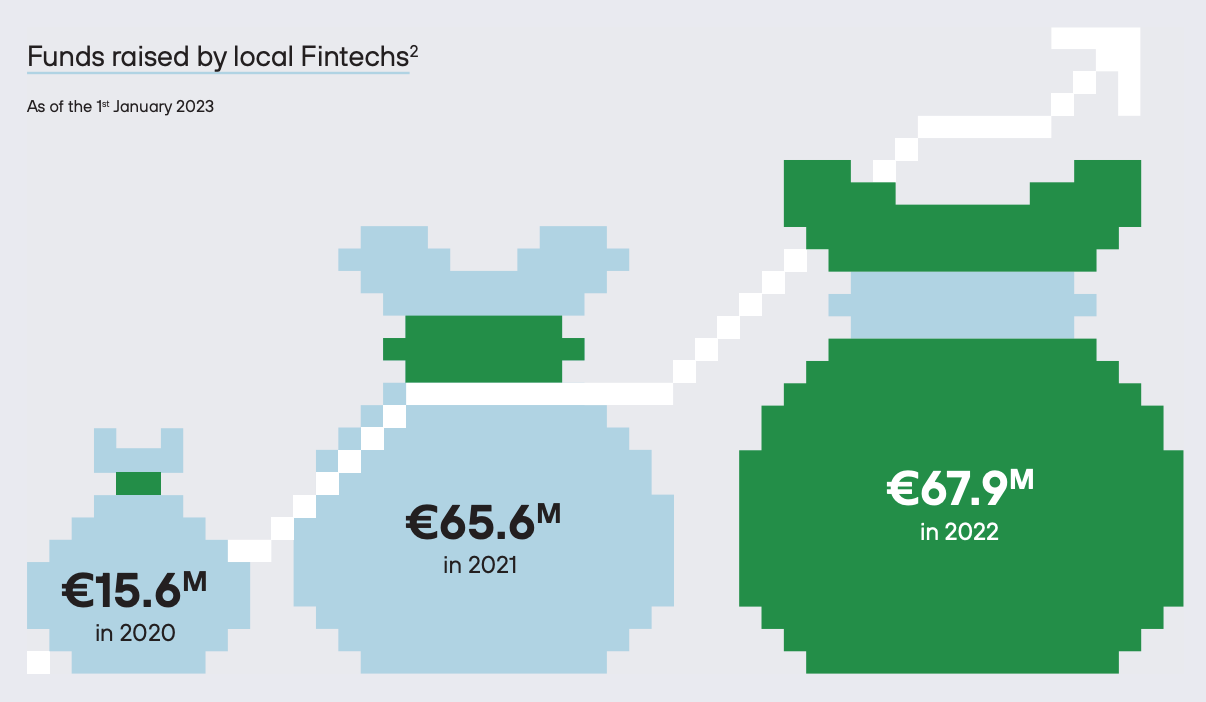

Despite a global venture capital (VC) funding turndown in 2022, uncertainty in the markets and looming economic slowdown, fintech companies in Lithuania managed to secure a considerable total of EUR 67.9 million in funding last year, up a 3.5% compared with 2021.

Four rounds were closed in 2022, according to the report: Kevin., an account-to-account payment infrastructure provider which raised one of the country’s largest Series A round at EUR 61.6 million; myTU, a mobile banking platform which closed a EUR 5 million Seed round; DeepFin, a personal financial assistant for freelancers which secured EUR 685,000 in Pre-Seed; and Okredo, an open data startup that raised EUR 650,000 in Seed funding.

Funds raised by local fintech companies, Source: Fintech Landscape in Lithuania 2022-2023, Invest Lithuania, March 2023

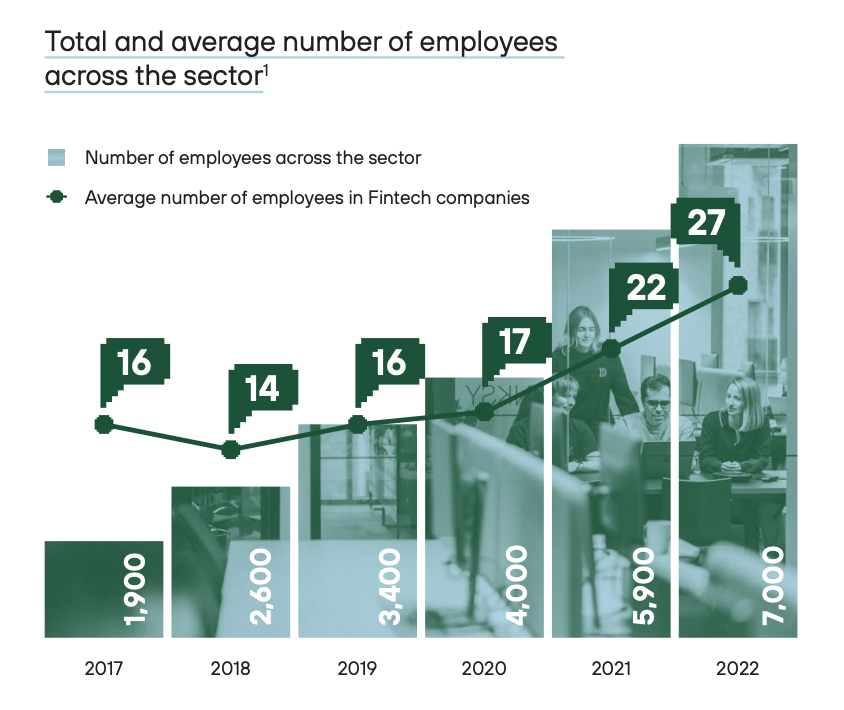

As of the end of 2022, Invest Lithuania identified 263 fintech companies operating in the country, down 2 companies from 2021. Despite the slight decrease, the number of people working in the sector increased by 18.6% in 2022 to reach an all-time high of 7,000. The boost pushed the average number of employees across the sector to 27 people, compared with 22 in 2021.

Total and average number of employees across the sector, Source: Fintech Landscape in Lithuania 2022-2023, Invest Lithuania, March 2023

Survey respondents demonstrated optimistic headcount growth predictions for 2023, with 90% sharing plans to hire additional employees this year. 74% of the companies surveyed expect to add up to 20 employees to their headcount in Lithuania, while 16% expect to add more than 20 employees.

Fintech predictions for 2023

The study, which also sought to understand industry players’ views on emerging fintech trends, found that open banking, instant payments, embedded finance and digital currencies remain the hottest fintech segments this year.

Green finance is another segment to look out for, the report says, which notes that several fintech neobanks in Lithuania have already started offering products with positive environmental impact, including decarbonization, tracking of shopping and automatic offsetting of purchased items, and that new conducive policies will be fueling the growth of the sector.

Lithuania, which has set out the ambition to become a regional hub for sustainable finance, recently unveiled its Sustainable (Green) Finance Action Plan for 2023-2026, an action plan intended to promote the development of green public and private finance in Lithuania and create a favorable environment for both business and financial market participants investing in it.

Finally, the report highlights the upcoming National Fintech Guidelines for 2023-2028, a national strategy that’s set to boost the growth of the Lithuanian fintech sector across the board.

The guidelines, which are said to be in their last stages of development, will seek to secure further maturity and qualitative development of the sector and turn Lithuania into “the European high value-added fintech hotspot,” the report says.

They will be centered around five key pillars: enticing foreign fintech leaders to set up shop in Lithuania, creating favorable conditions for companies to expand their product portfolio and attract new clients, improving the Lithuanian fintech sector’s global recognition, building fintech competencies, and strengthening risk management procedures to increase the operational maturity of fintech companies.

Fintech Startup Map Lithuania 2023

We have listed all the Lithuanian Fintechs on this sub-page:

Featured image credit: edited from Freepik

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.