Nordic Countries Emerge as Front-Runners in Open Banking Adoption

by Fintechnews Baltic January 21, 2021The Nordic countries are placing themselves at the forefront of the open banking movement. In Denmark, Finland, Norway and Sweden, traditional financial institutions and fintechs are rapidly embracing the trend which they perceive as a major opportunity for their businesses, a research commissioned by Nordic API Gateway found.

Access to financial data through PSD2 is an opportunity for your business, The Nordics are accelerating open banking opportunities across industries, Nordic API Gateway, May 2020

The study, conducted in early 2020, found that out of more than 100 decision makers within the financial sector, payment and accounting services industries, 82% viewed open banking as an opportunity, and 58% believed that PSD2 had already had a positive impact on the Nordic economy.

Impact of open banking on the Nordic economy, The Nordics are accelerating open banking opportunities across industries, Nordic API Gateway, May 2020

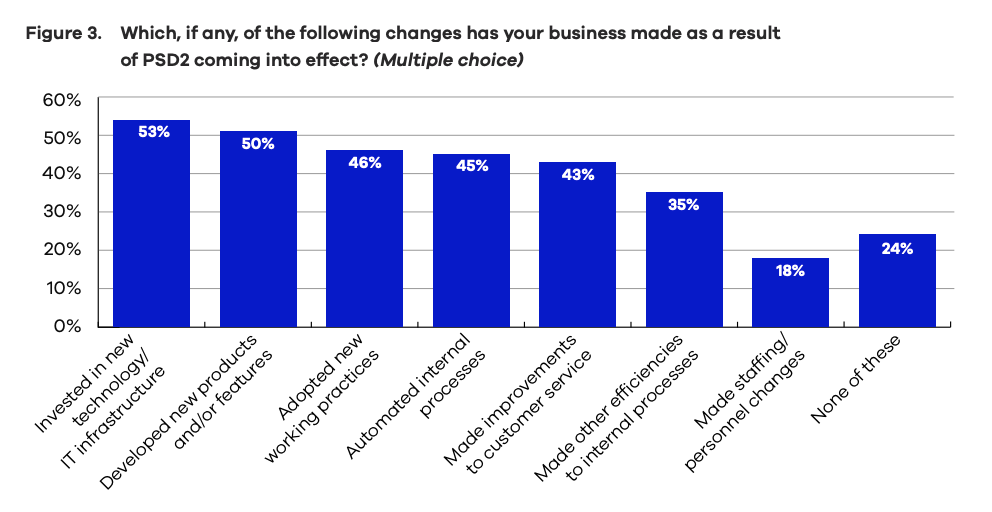

The research found that Nordic financial institutions and fintechs were well aware of open banking and quick to adopt the trend. In less than six months after PSD2 came into effect, Nordic financial companies had already made changes, with 76% of those surveyed reporting at least one development. 53% had invested in new technology or IT infrastructure, and half had developed new products or features.

Changes as a result of PSD2, The Nordics are accelerating open banking opportunities across industries, Nordic API Gateway, May 2020

Nordic banks, fintechs embrace open banking

Danish accounting software provider Kontolink is just one of the many financial services providers that benefited from open banking. By gaining access to real-time bank data, Kontolink CEO Kim Agger said the company was able to significantly refine its product as well as improve accuracy and effectiveness.

Business spending platform Pleo is another fintech startup that was quick to embrace open banking. In 2019, the fast-growing company began using access to all Nordic banks to create smarter business expense solutions for its customers. Pleo is a smart company card solution focused on simplifying bookkeeping.

In the traditional banking industry, Norway’s biggest lender DNB has been among the front-runners in customer interface and experiences. Since 2018, the bank has provided customers with the ability to aggregate all of their different bank accounts into DNB’s mobile banking app.

As the bank continues to work towards becoming the favored mobile banking app for Norwegians, DNB has now morphed into a next-level open banking solution that continuously expand its services to meet customers’ changing needs. Most recently, DNB began allowing customers to perform instant account-to-account payments from any bank within its mobile app.

Information compiled by Latvian open banking startup Nordigen suggest that most of the largest banks in the Nordic region now provide open banking developer portals that give regulated access to account information. Active portals include those provided by Swedbank, Nordea, SEB, Danske Bank, Bank Norwegian, Ikano Bank, Handelsbanken, Aktia Bank, S-Pankki, OP Financial Group, Nykredit Bank, Jyske Bank, Sydbank and Spar Nord Bank.

A preferred destination for innovation testing

Looking at the number of third-party providers (TPPs) utilizing open banking in Europe, the research found that although the UK has the highest number of domestic TPPs, the Nordic region appears to be the preferred location for foreign companies looking to test their new open banking services.

Compared to the size of its population, the number of TPPs passporting into the Nordics is very high, indicating strong interest from overseas companies. According to the study, this might be due to the region’s reputation for being an ideal testbed when it comes to trying out new tech solutions. The region is also well known for its high levels digitalization and tech-savviness.

TPPs per million inhabitants (February 2020), The Nordics are accelerating open banking opportunities across industries, Nordic API Gateway, May 2020

Open banking leaders in the Nordics

Another reason for the Nordic region to be attracting so many foreign TPPs might also be because these countries now offer high-quality API aggregation services with companies including Tink, Nordic API Gateway and Open Payments putting the region on the map.

Tink is a cloud-based open banking platform which offers products such as account aggregation, payment initiation, data enrichment, and personal finance management that can be used to develop standalone services or be integrated into existing banking applications.

Tink links up 3,400 banks, covering some 250 million people, and processes payments for clients including Swedish digital mailbox provider Kivra, and French payment fintech Lydia.

Founded in 2012, Tink is based in Stockholm, Sweden, and counts amongst its backers PayPal Venture, ABN AMRO Ventures, BNP Paribas’ venture arm and Opera Tech Ventures. It has raised EUR 175 million in funding so far.

In Denmark, Nordic API Gateway is perhaps the most well-known open banking platform. A product owned and developed by Spiir, Nordic API Gateway offers an open banking platform that makes it possible to integrate directly into all banks’ APIs from one place. The platform currently integrates with the vast majority of banks in the Nordic region – both private and business accounts – and is expected to be launched in all of Europe later this year.

Open Payments is another Nordic startup that’s rapidly making a name for itself on the open banking scene. Founded in 2017 and headquartered in Stockholm, Open Payments is the developer of an open banking platform that gives access to different types of financial services through a unique and secure API. The startup has raised more than EUR 4 million in funding so far.

Another open banking/PSD2 data provider from the Nordics is Neonomics. Formerly known as Bankbridge. Neonomics provides a banking platform that gives access to identity data, balance, transaction history and fund coverage, payment initiation, payment details query and payment status. According to Nordigen, Neonomics supports more than 1,300 banks across Europe. The startup was founded in 2017 in Norway.

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.