In Lithuania, the fintech ecosystem rose steadily last year, showing resilience and maturity in the face of the continued global economic downturn.

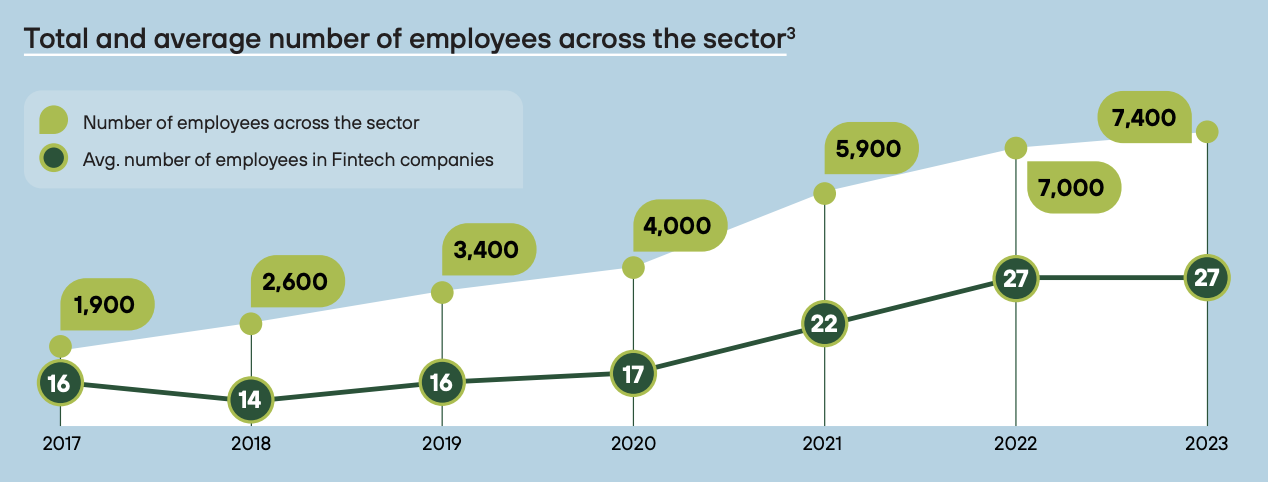

Data freshly released by Invest Lithuania, the country’s investment promotion agency, reveal that the number of companies in the domestic fintech sector increased by 5% to more than 270 companies in 2023, while the industry’s talent pool grew by 6% to surpass 7,400 professionals.

Total and average number of employees across the sector, Source: Fintech Landscape in Lithuania 2023-2024, Invest Lithuania, Mar 2024

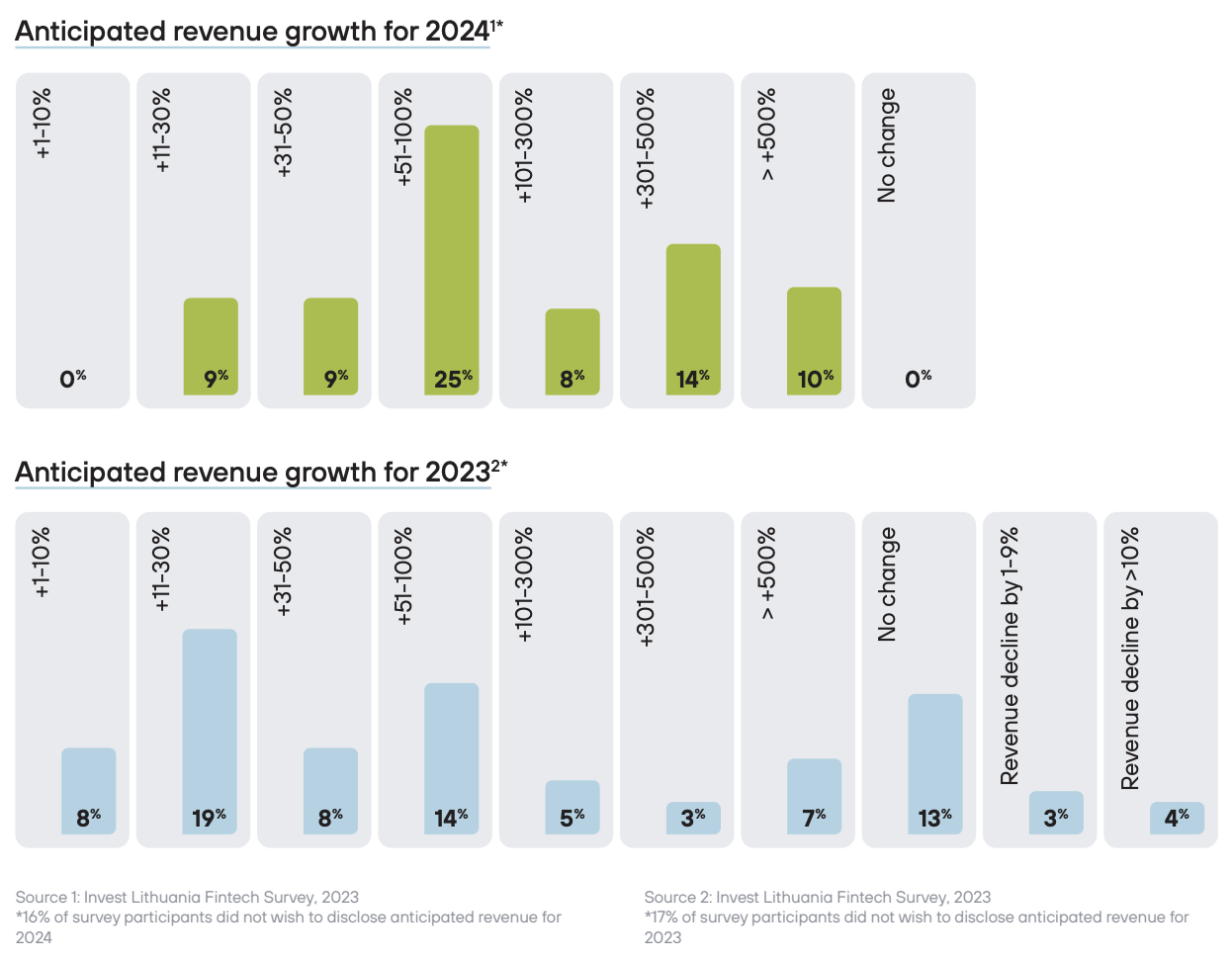

The data, featured in the Fintech Landscape in Lithuania 2023-2024 report, paint a bullish picture of the Lithuania fintech landscape. In addition to the industry’s growth in 2023, a survey of 77 industry stakeholders, or 28% of the market, found that participants recorded revenue growth in 2023.

Of the fintech companies polled, 64% of the respondents reported their organizations being poised for revenue growth in 2023, with an impressive 15% projecting to more than double their revenues.

The outlook for 2024 is even more promising, with a remarkable 75% of Lithuanian fintech companies anticipating consistent revenue growth, and over 30% foreseeing their revenues at least doubling. These projections reflect a strong and optimistic confidence in the market’s potential for the coming year.

Anticipated revenue growth for 2023 and 2024, Source: Fintech Landscape in Lithuania 2023-2024, Invest Lithuania, Mar 2024

To sustain their anticipated growth, the study found that Lithuanian fintech companies are looking to increase their headcount in 2024, with a particular focus on specialists in software development (40%), compliance and anti-money laundering (AML) (29%) and business development (29%).

Most sought after specialists, Source: Fintech Landscape in Lithuania 2023-2024, Invest Lithuania, Mar 2024

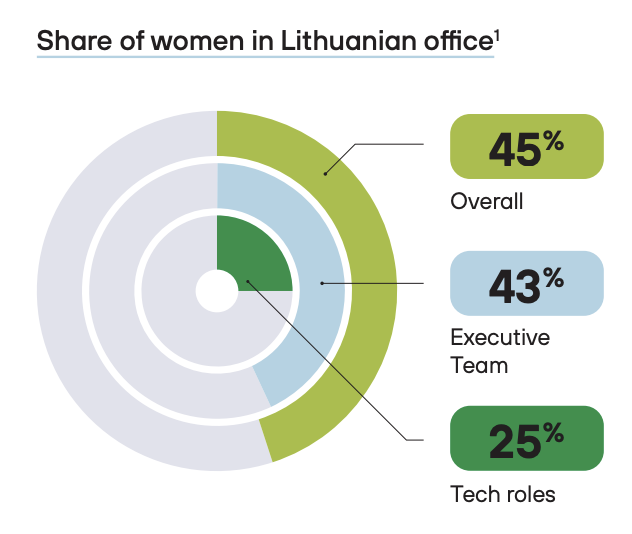

2023 also saw improvements in gender parity. In 2023, women made up 45% of the overall workforce and 43% of executive positions, the study found. In technical roles, women accounted for 25% of the workforce, a figure that ranks among the best in terms of female representation in the information and communications technology (ICT) industry across Europe, the report says.

Share of women in Lithuanian offices, Source: Fintech Landscape in Lithuania 2023-2024, Invest Lithuania, Mar 2024

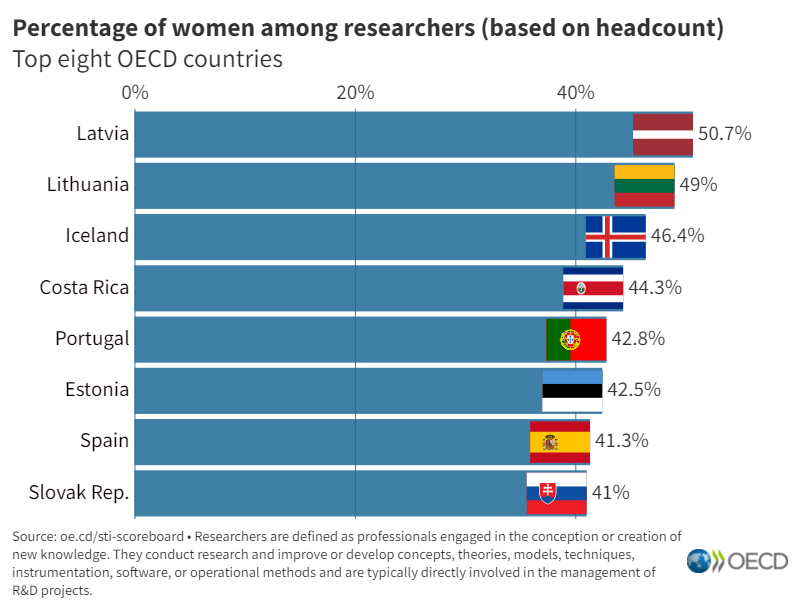

Lithuania is positioned among the top countries in the world in gender equality. In 2023, the country ranked 9th globally in the World Economic Forum’s Global Gender Gap Index, an annual research which benchmarks the state and evolution of gender parity across key dimensions including health, political empowerment and economic opportunity.

The Organisation for Economic and Co-operation and Development ranks Lithuania the second country worldwide in terms of percentage of women among researchers (49%), behind only Latvia (50.7%).

Percentage of women among researchers based on headcount, Source: OECDInnovation via X, Mar 2022

Despite these progresses, the study also revealed that Lithuanian fintech companies are facing several challenges, identifying compliance and regulations (44%), economic conditions (43%) and the geopolitical climate (43%) as their primary concerns for 2024.

Key challenges for 2024, Source: Fintech Landscape in Lithuania 2023-2024, Invest Lithuania, Mar 2024

The Lithuanian fintech sector

The growth of the Lithuanian fintech ecosystem in 2023 came on the back of significant developments. Notable milestones include the release of the Fintech Guidelines 2023-2028, which lays out a framework for the further growth and development of the sector, as well as Lithuania becoming one of the top 3 countries for licensed crowdfunding service providers in the European Union.

Lithuania is also actively preparing to quickly adapt to the forthcoming Markets in Crypto-Assets (MiCA) regulation. The nation aims to position itself as a leader in embracing the regulation and become a prime destination for companies seeking to operate MiCA-compliant crypto businesses in Europe.

Lithuania is currently home to 277 fintech companies, data from fintech hub and startup program organizer Rockit show, up from 263 in 2022. Notable organizations that joined the Lithuanian fintech landscape last year include Hokodo, a UK buy now, pay later provider, Payhawk, a spend management solution from the UK, Windcave, a payment gateway from New Zealand, and Plug and Play, a global venture capital firm, innovation platform and accelerator.

Fintech Lithuania Map 2024

Fintech in Lithuania in 2024 by Rockit, Source: BlackUnicornPR via X, Mar 2024

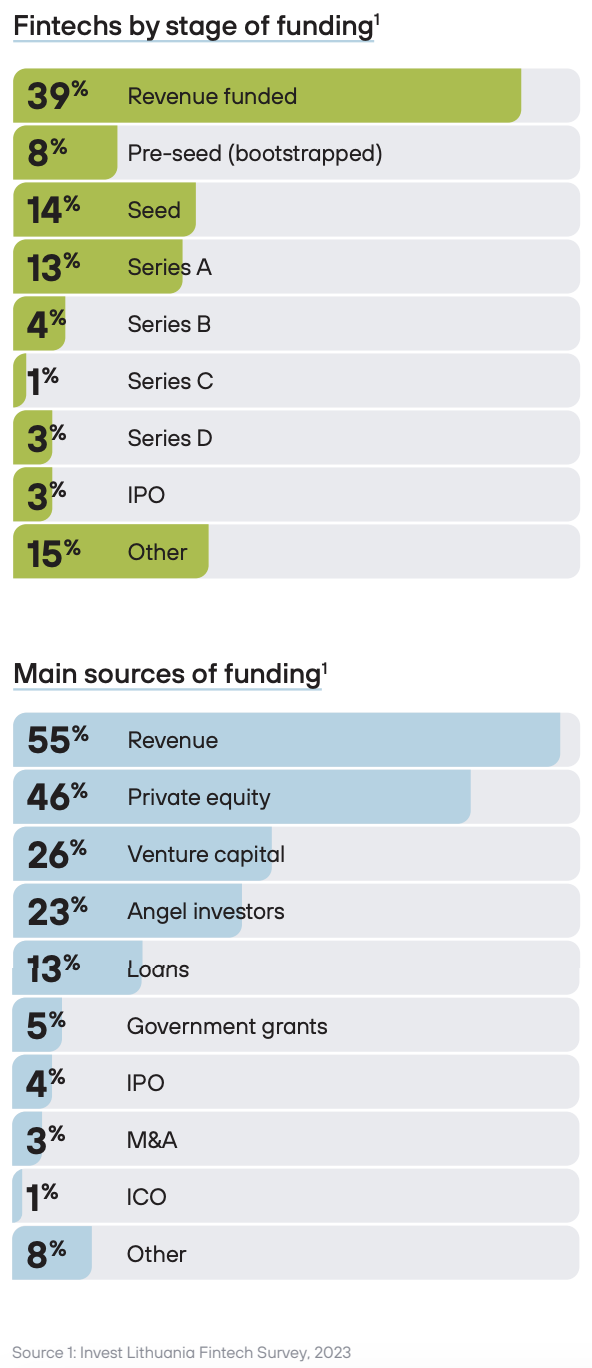

Results of the 2023 industry study indicates that the Lithuanian fintech market is stable and maturing, with a significant portion of the sector, approximately 39%, primarily relying on revenue funding.

Lithuanian fintech companies by stage of funding, Source: Fintech Landscape in Lithuania 2023-2024, Invest Lithuania, Mar 2024

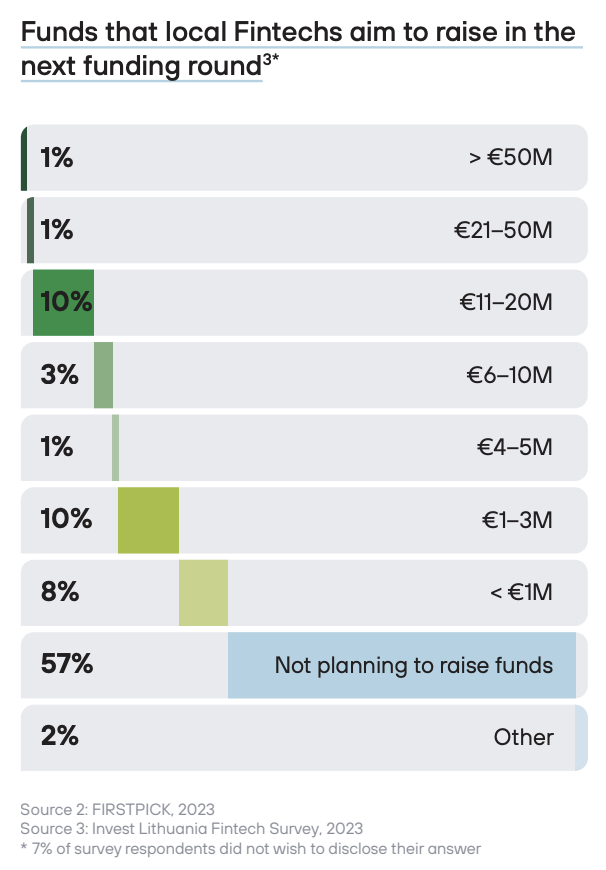

Moreover, about 57% of surveyed companies are not actively seeking additional funds. This pattern suggest a preference for incremental and sustainable growth models and a cautious approach to fundraising.

Funds that local fintech companies aim to raise in the next funding round, Source: Fintech Landscape in Lithuania 2023-2024, Invest Lithuania, Mar 2024

Featured image credit: Edited from freepik

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.