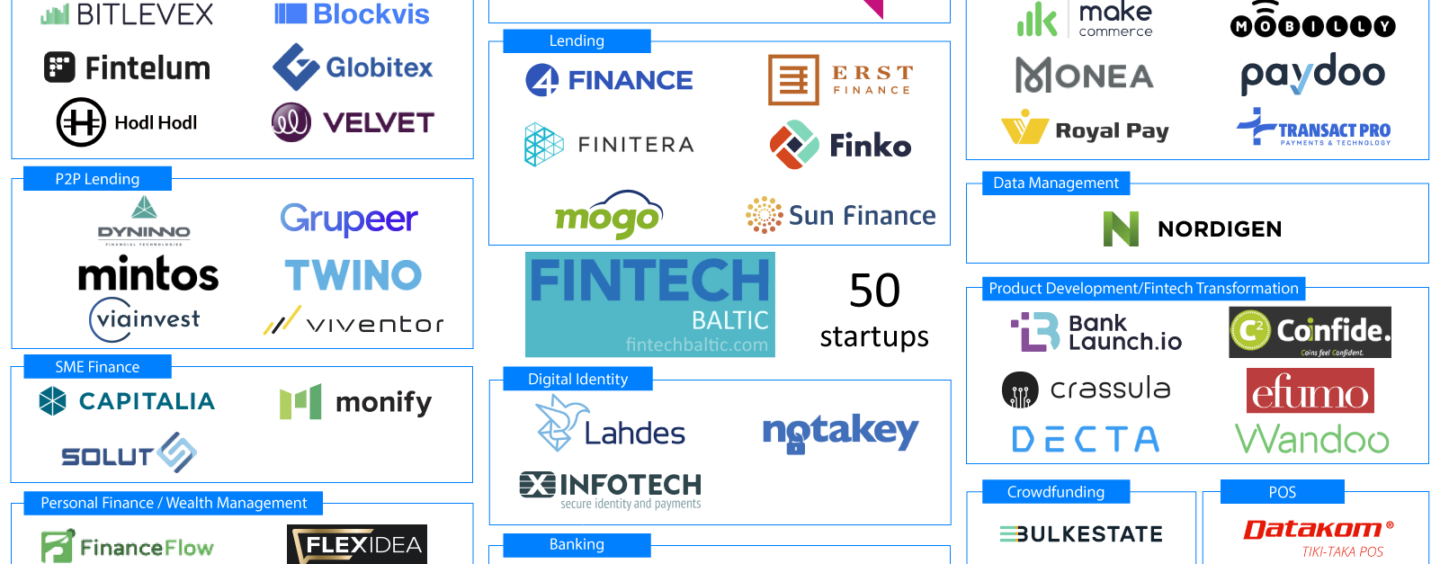

Like other Baltic nations, Latvia has witnessed the steady growth of a fintech scene. Today, the country is home to 50 fintech startups and has rapidly expanding blockchain and alternative lending segments, according to the Fintech Latvia Startup Map 2020.

In Latvia, there are currently seven fintech companies operating in the crypto/blockchain space. These include Bitfury, a leading security and infrastructure provider, Axioma, a developer of blockchain solutions, Blockvis, a blockchain consulting and development agency, Netcore, a web development company, and Velvet, a blockchain-powered deal platform.

In the peer-to-peer (P2P) lending and alternative finance space, notable Latvian startups include P2P lending platforms Mintos and Viainvest, digital consumer lending group 4Finance, as well as Monify, which provides unsecured online loans to small and medium-sized enterprises (SMEs) in the Baltics and Poland.

Besides blockchain and alternative lending, Latvia is also home to payments startups, including Monea, a micropayment app, and Mobilly, a mobile payments platform, and digital identity startups such as Notakey, a smartphone-based identity and access management solution.

Other noteworthy fintech startups from Latvia include Altero.lv, a company providing clients with loan brokerage services, FinanceFlow, a cash management software, Lahdes, an e-document management system, and Nordigen, an account data analytics provider.

Latvia’s fintech ecosystem

Latvia’s fintech industry, though still nascent, has grown over the past couple of years on the back of new, favorable regulations, the launch of funds and programs to support the local startup ecosystem, and increased fintech adoption from both consumers as well as the traditional financial services industry.

In 2017, Latvia implemented the innovative Startup Law, which aims to encourage the creation of startup businesses. The law includes special tax breaks and eases visa restrictions, making it easier to recruit a global workforce.

On the investors front, Swedish financial group SEB launched in 2018 a new venture capital investment program for Baltic fintechs in 2018. Its purpose is to identify and support the most promising startups that have ideas with potential benefits for the bank’s clients.

Startup Wise Guys, a B2B startup accelerator originally from Estonia but which covers the whole Baltic region, is currently running its third Wise Guys Fintech program in Vilnius. The third edition of the program is supported by Latvian bank Swedbank, Google Developers Launchpad and Sorainen, a business law firm operating across the region. In 2019, Latvian fintechs continued to grow and gain traction.

In P2P lending, Mintos has recorded significant growth, reaching EUR 4 billion in total loans financed in January 2020. Mintos was named the Alternative Finance Platform of the Year at the AltFi Awards 2019.

Meanwhile, Viainvest expanded its product portfolio with small business loans in December, and Twino, another P2P lending marketplace and online investment platform, said in October it had reached EUR 1 billion in loans issued since its inception in 2009. Twino said half of that amount had been issued during the past three years, signaling the growth of the company.

In blockchain and crypto, Bitfury was named amongst the most innovative fintech companies of 2019 by Forbes. The company recently inked a partnership with the United Nations Development Program (UNDP) for a carbon reducing initiative in Kazakhstan.

For a full list of all Fintech Latvia companies, you can check out our list here.

Note please: This is the first draft of the Latvian Fintech Map, in case your Fintech is missing or wrong categorized, keep calm and send us an email.