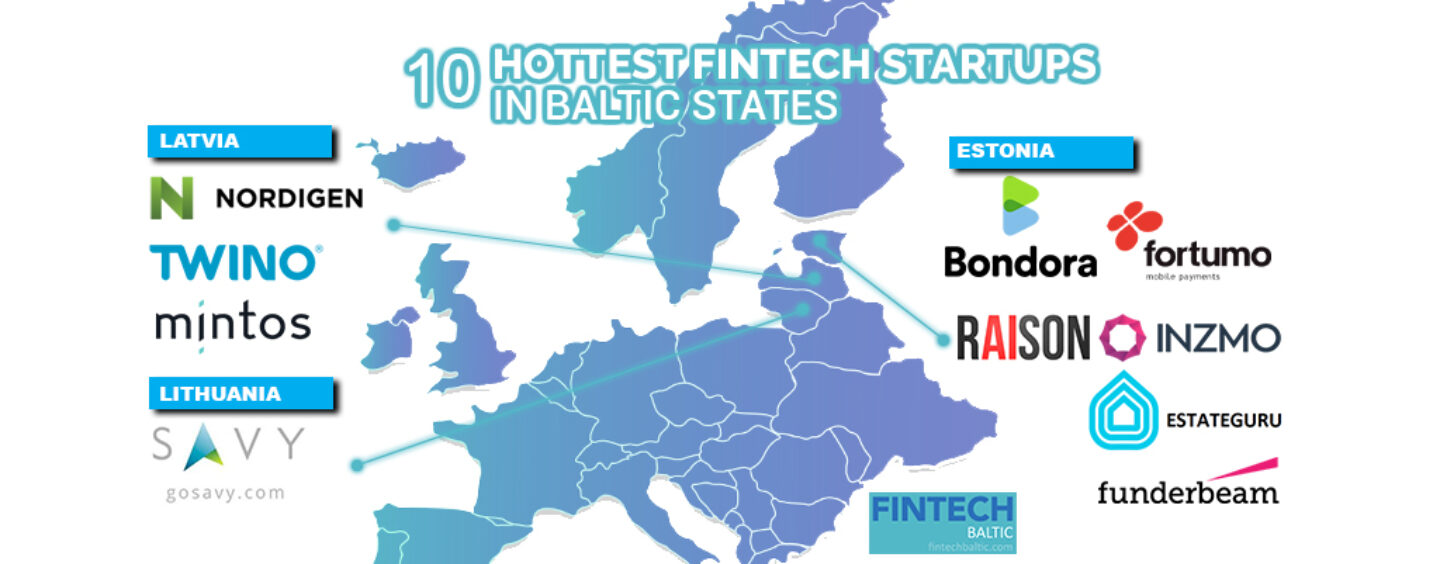

Despite being a relatively small market compared to its other European counterparts, the Baltic region is quickly surging ahead in the global fintech race. It was once hailed by the World Economic Forum as one of the most innovative region within the European Union.

While it is most famous for giving birth to big names like Skype and the now London-based Transferwise, it is also home to a sizeable number of cutting edge fintech startups.

Lithuania alone is home to over 170 fintech startups, while Estonia is home to over 80 fintech startups, whereas Latvia’s fintech industry is said to be worth $878 Million.

To dispel the myth that the region is only about Skype and Transferwise, here at 10 of the top fintech startups in Baltic you should keep an eye on.

Estonia

Fortumo

Fortumo is a mobile technology company developing a platform for app stores and digital service providers for user acquisition, monetization and retention. Fortumo’s products allow digital merchants to manage the end-to-end customer lifecycle of mobile users on more than 350 mobile operator networks through bundling, carrier billing and messaging solutions. The company serves thousands of leading digital merchants including Google, Spotify, Electronic Arts and EasyPark.

In January, Fortumo launched PayRead, a payment solution that lets digital publishers identify and charge users through their SIM card, the most widely available digital identity globally.

Bondora

Bondora is one of the largest non-bank digital consumer loan providers in Continental Europe. The platform focuses on unsecured consumer loans with principal amounts of EUR 500 to EUR 10,000 and repayment terms ranging from three to 60 months.

Bondora is licensed as a credit provider by the Estonian Financial Supervision Authority. In January, the company announced that its P2P lending marketplace platform had more than 42,000 investors from 85+ countries worldwide who had invested over EUR 150 million.

Funderbeam

Founded in 2013, Funderbeam is a funding and trading platform for high-growth private companies. Powered by blockchain technology, the platform helps founders raise funds beyond borders and provides access to early stage equity investors.

For founders, Funderbeam provides access to a community of high quality, active investors who can add value to their project. For investors, Funderbeam provides access to a community of ambitious growth companies. Each business has a lead investor who will act as an ambassador for the deal.

Funderbeam is currently growing its business both in the UK and other jurisdictions in the EEA, including Denmark, Estonia, Finland, Croatia.

Inzmo

Inzmo is an insurtech startup and the developer of an insurance purchasing platform created to get insurance cover and personal insurance products over mobile application.

The company’s insurance purchasing platform offers a fully digitalized B2B2C insurance process covering all the key stages, including taking out cover, managing contracts, partnerships and aims reporting.

EstateGuru

EstateGuru is a leading European marketplace for short-term, property-backed loans. The P2P lending marketplace has facilitated more than 680 loans worth in excess of EUR 103 million. Over 21,500 investors from 45 countries have earned average returns of 12.2% by backing property loans in Estonia, Latvia, Lithuania, Spain, and Finland with the UK, Ireland and Portugal to follow soon.

In February, EstateGuru recruited Andres Luts, former head of retail credit risk at Coop, and Mihkel Roosme, former head of division at Swedbank, who now serve as the company’s Baltic risk manager and head of business development, respectively.

RSN Finance

Founded in 2017, RSN Finance is the operator and developer of Raison, an artificial intelligence platform designed to handle investments and personal finance. Raison aggregates all information about a customer’s cash flows (bank accounts, traditional investments, crypto) and develops different patterns based on the collected data to give personal advice to customers.

The company focuses on functional simplicity and specifically targets the Western European market. Further market development prioritizes Eastern Europe, Great Britain, and the US.

Latvia

Mintos

Launched in 2015, Mintos is an online marketplace for loans, connecting retail and institutional with borrowers of non-bank lenders. At Mintos, both retail and institutional investors can invest in fractions of loans originated across different continents and loan types. Currently, the company offers the opportunity to invest in mortgage loans, personal unsecured loans, secured car loans, invoices, and small business loans.

Last month, Mintos reached EUR 2 billion in total loans financed and established the Mintos Impact Fund, an environmental sustainability initiative to protect the Baltic Sea.

Twino

Twino is one of the leading P2P platforms in Eastern Europe. It was the first platform to offer loans in Kazakhstan, and has claimed a significant share of Russia’s P2P lending market. Other markets the company serves include Latvia, Poland, Georgia and Denmark.

Twino has funded more than EUR 500 million in unsecured consumer loans since it was launched in 2009.

Nordigen

Founded in 2016, Nordigen is a global account data analytics provider that helps banks and lenders improve the speed and accuracy of their credit decisions. The company offers account-based income verification, transaction categorization, and behavioral scoring solutions.

Nordigen is headquartered in Latvia and operates across 15 countries, including Spain, Germany, Poland, Sweden, Denmark, Finland, Latvia, Estonia, Lithuania, Australia, New Zealand and Brazil, working with 60+ global banks and lenders.

In January, Nordigen signed a partnership with Nordic financial services group SEB to test Nordigen’s transaction categorization and behavioral analysis capabilities.

Lithuania

Savy

Savy is a P2P lending platform for consumer loans and the first to launch in Lithuania back in 2014. The platform connects investors with borrowers across Europe.

Unlike other lending platforms, Savy does not use deposit account to collect money or distribute payments. The platform connects investors and borrowers directly via their bank accounts.

The company claims over 23,660 investors on its platform who have invested more than EUR 18 million in loans and received EUR 3 million in interest.

For a full list of all Fintech Latvia companies, you can check out our list here.