Posts From Fintechnews Baltic

P2P Insurance Platform Completes Year-Long Testing in Bank of Lithuania’s Sandbox

Ooniq, peer-to-peer insurance platform of Workpower, has completed a year-long of testing within the Bank of Lithuania’s regulatory sandbox. The regulatory sandbox allows companies developing innovative financial products and business solutions to test them in a real environment under supervision

Read MoreIdenfy and Verifo Join Forces to Secure International Payments

Real-time identity verification service iDenfy and international payment platform Verifo announced that they are partnering to secure financial transactions. Verifo said that not only it facilitates cross-border wire transfers, payment collections, and currency exchange services, they also offer customisable all-inclusive

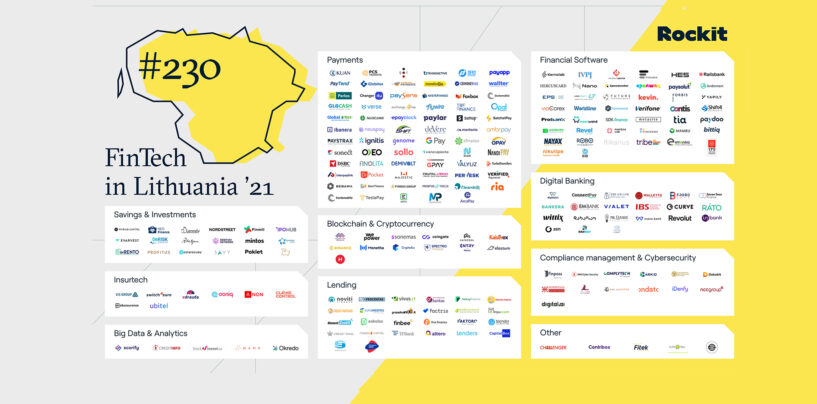

Read MoreBooming: Lithuania’s Fintech Report and Startup Map 2021

Despite headwinds caused by the COVID-19 pandemic, Lithuania’s fintech landscape continued to grow in 2020 with 40 new companies setting up operations, bringing the total number of fintechs in the country to 230, according to Lithuanian investment promotion agency Invest

Read MoreRevolut Bank Launches Operations in Estonia

Revolut, a British fintech company offering banking services, announced that it has operationalised its European specialised banking license in Estonia. The specialised bank license allows Revolut Bank to provide limited banking services via its app along with an array of

Read MoreLithuanian SME Digital Financing Granted a Specialised Bank License

The European Central Bank (ECB) has granted Lithuanian capital company SME Digital Financing a specialised bank license following the assessment and proposal of the Bank of Lithuania. Having secured the license, SME Digital Financing will now be able to accept

Read MoreSwedish Central Bank Extends Digital Currency Pilot Project e-Krona Until 2022

Sveriges riksbank, the central bank of Sweden, announced that it will be extending its central bank digital currency (CBDC) pilot project named e-krona to the end of February 2022. Riksbank conducted the pilot project in partnership with Accenture, to develop

Read MoreSwedish Neobank Northmill Raises US$30 Million

Northmill Bank, a Swedish neobank, raised US$ 30 million (SEK 250 million) in a funding round led by M2 Asset Management, a Swedish investment company controlled by Rutger Arnhult, and the institutional investor and asset management firm Coeli. Northmill Bank

Read MoreSwedish Payment Platform Billhop Raises €4 Million in Series A Funding

Billhop, a Swedish company which enables businesses and individuals to pay their invoices by credit card, has closed a €4 million Series A investment round from fintech venture firm Element Ventures. Billhop said that the latest investment from Element Ventures

Read MoreIKEA Makes Banking Moves With 49% Stake Acquisition in Ikano Bank

Ingka Group, the parent company of furniture retailer IKEA, announced that it has acquired a 49% stake in Ikano Bank with the option to acquire the remaining shares at a later date. The transaction is subject to approvals by the

Read MoreLithuanian Paysera Raked in EUR 13 Million in Revenue for 2020

Paysera, a Lithuanian payment processor, announced that it has raked in EUR 13 million in revenue in 2020 which exceeded the revenue of 2019 by 17 percent. The company reported that its unaudited net profit in 2020 was EUR 3.4

Read More