Posts From Fintechnews Baltic

Lithuanian Neobank SME Finance Reported 57% Revenue Increase In 2020

Lithuanian-based neobank SME Finance has reported that it chalked up fiscal revenues of EUR 7.7 million in 2020, which showed a 57% increase from the previous fiscal year. The neobank said that its growth was driven primarily by a significant

Read MorePayments Provider SumUp Acquires Lithuanian Fintech Paysolut

London-based payment service provider SumUp has acquired Paysolut, a Lithuanian core banking system provider for an undisclosed sum. The acquisition will help Paysolut expand its team and offer a new level of quality products. In terms of Paysolut’s future, SumUp

Read MoreFintech Veriff Among Winners of Estonian Startup Awards 2020

The Estonian Startup Awards 2020 organised by Estonian Founders Society, LIFT99 and Startup Estonia, has announced winners in 9 categories among which fintech startup Veriff bagged The B2B Saas Startup of 2020 award. Launched in 2019, the award recognises the

Read MoreCrunchfish Implements Digital Cash on Cards

Crunchfish announces a new patent pending innovation with application number SE2150109-3 that extends offline frictionless mobile payments to also support payment cards. This is especially important in CBDC implementations as cards as a bearer instrument is important to ensure financial

Read MoreFinnish Proptech CHAOS Raises €1.5 Million in Funding Round Led by Nidoco

Finnish proptech platform CHAOS has announced the successful closure of a €1.5 million funding round led by sustainability-focused Swedish investment firm Nidoco. Angel investors Kai Keituri, Tapio Heikkilä, and Stefan Lindberg had also participated in the funding round. The investment

Read MoreLithuanian Fintech Genome Chosen as the Payment Provider for m.Parking in Vilnius

UAB Maneuver (Genome), an electronic money institution focused on alternative banking and payment solutions, will be the payment provider for parking services in Vilnius, Lithuania. Genome said that its services will be available in three more cities namely Kaunas, Klaipėda,

Read MoreLithuanian Startup Kevin Raises €1.5 Million to Break Into New European Markets

kevin., a Lithuanian payments startup, announced that it has raised €1.5 million in seed funding to scale into new markets in Europe. The funding came from a number of European business angels from the finance and insurance industries. kevin. currently

Read MoreSvea Finland Ties up With Nordic API Gateway to Boost E-Commerce Checkout

Payments service provider Svea and Nordic API Gateway, Denmark’s open banking platform, signed a new partnership that is set to boost e-commerce checkout for a wide range of merchants in Finland through the latter’s platform. The open banking platform is currently

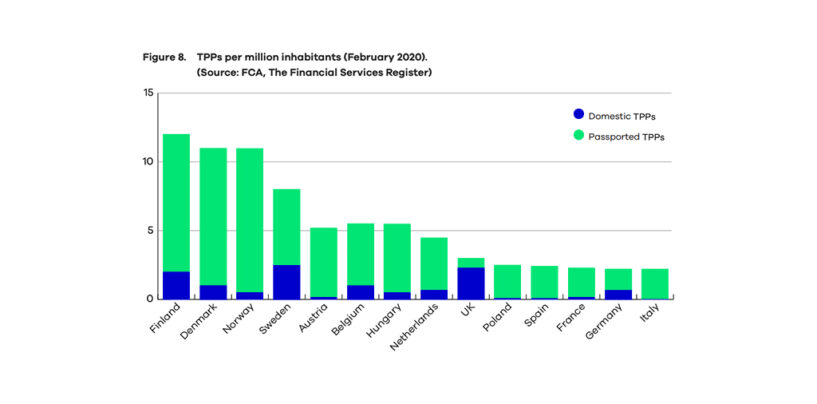

Read MoreNordic Countries Emerge as Front-Runners in Open Banking Adoption

The Nordic countries are placing themselves at the forefront of the open banking movement. In Denmark, Finland, Norway and Sweden, traditional financial institutions and fintechs are rapidly embracing the trend which they perceive as a major opportunity for their businesses,

Read MoreLithuanian Payments Firm Paysera Expands Its Footprint to Spain

The Lithuanian-based e-payment network Paysera has announced its expansion plans to Spain, where the company Paysera España was established in the city of Valencia. Financial services and a trademark developed in Lithuania are brought to Spain by the owners of

Read More