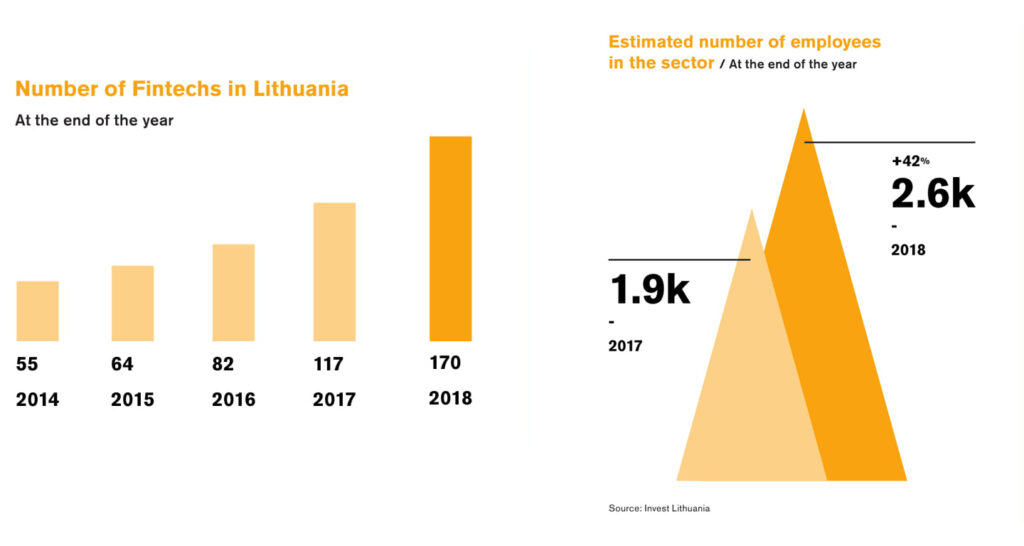

Over the year, the number of Lithuanian-based FinTech companies and their employees grew by more than 40%.

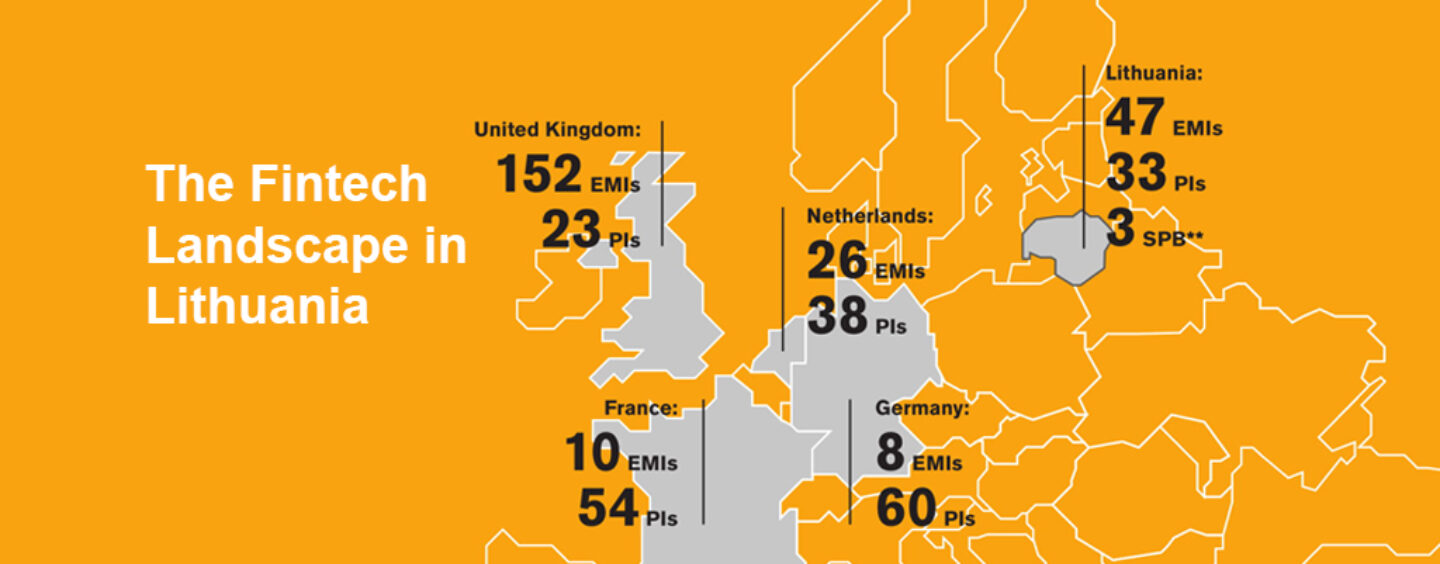

In addition, by number of licensed electronic money institutions, Lithuania was in the lead in continental Europe. The results of the FinTech sector in 2018 were presented by the representatives of the Bank of Lithuania, the Ministry of Finance, Invest Lithuania and Rise Vilnius at the event taking place today at Rise Vilnius, a FinTech co-working space.

Vilius Šapoka

“With the ever-accelerating technological progress, we strive to strike a balance between speed and safety and to create a regulatory environment supportive to both business and the residents of Lithuania. Last year our efforts were successful. The changes were welcomed not only by experts but, more importantly, large international companies which chose Lithuania due to its progressive legal environment and conditions which encourage growth. Further changes are foreseen in the future as Lithuania charts its path to becoming a regional FinTech hub,”

said Vilius Šapoka, Minister of Finance.

At the beginning of the year, the government approved an action plan that aims at fostering the development of FinTech sector, further improving the legal environment, increasing demand in FinTech products and services, and it focuses in particular on managing risks (AML/TF risks, offences related to consumer protection). Improving identification methods, establishing an international 16+1 FinTech coordination centre with China and preparing the concept of the ecosystem for cashless payments in educational institutions is on the agenda in 2019.

Marius Jurgilas

“We are at the forefront of innovation and encourage competition in the financial services sector that is, first of all, useful to consumers. We have given a green light to innovators and try to ease their entry into the market. However, it does not mean that the doors are open to everyone – market participants must meet our high quality requirements, and before granting licences we thoroughly assess their goals and plans”,

said Marius Jurgilas, Member of the Board of the Bank of Lithuania.

Last year, the Bank of Lithuania implemented a smart e-licensing tool that allows potential financial market participants to remotely apply for a licence in faster, easier and less expensive manner. FinTech companies developing innovative financial products can test them in the Bank of Lithuania’s regulatory sandbox, and very soon they will be able to test blockchain-based services in a technological platform. Moreover, the central bank promotes the development of Open Banking, a rapidly expanding field of the FinTech industry.

A supportive legal and regulatory environment in Lithuania caught the attention of such world-known companies as Google, Revolut, TransferGo and InstaReM.

Mantas Katinas

“Until now, Lithuania did not have a business sector with the potential to become the calling card of our country. FinTech companies have the opportunity to build a strong 5,000 talent cluster in Lithuania, which translates into higher salaries and substantial benefits to the budget of the country. Our country has already drawn the attention of companies from Israel, US, UK, Singapore and other global tech hubs. It is important not to lose momentum and move forward. This is our chance to take the lead globally,”

said Mantas Katinas, Invest Lithuania Managing Director.

During the event, representatives of Invest Lithuania and Rise Vilnius presented the FinTech Landscape in Lithuania Report for 2018. 82 companies established in Lithuania, almost a half of the market participants, participated in the survey.

In 2018, about 170 FinTech companies operated in Lithuania (in 2017 – 117). Over the year, the number of those working in this sector grew by 700 – to 2,600.

The report shows that as many as 70% of all FinTechs operating in our country are established in Lithuania; other companies have headquarters in and outside Europe – in Israel, Singapore and Hong Kong. More than 96% of FinTech companies operating in Lithuania see Europe as their target market, and more than a third also focuses on the Asian market, while a fourth – on the US market.

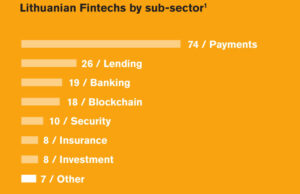

About a half of FinTechs established in Lithuania provide payment services and 80% of the surveyed provide their services to business clients. To add, contrary to popular opinion that FinTech industry is geared towards cryptocurrencies, only 5% of the surveyed companies raised funding through ICOs. More than a half of the surveyed stated that own-generated income is their main funding source.

About a half of FinTechs established in Lithuania provide payment services and 80% of the surveyed provide their services to business clients. To add, contrary to popular opinion that FinTech industry is geared towards cryptocurrencies, only 5% of the surveyed companies raised funding through ICOs. More than a half of the surveyed stated that own-generated income is their main funding source.

FinTech allows boosting competition in the financial service sector, offers a wider choice to consumers as well as simpler and potentially less expensive services. Innovation, including the field of finance, is one of the drivers of the economy, creating the largest added value.