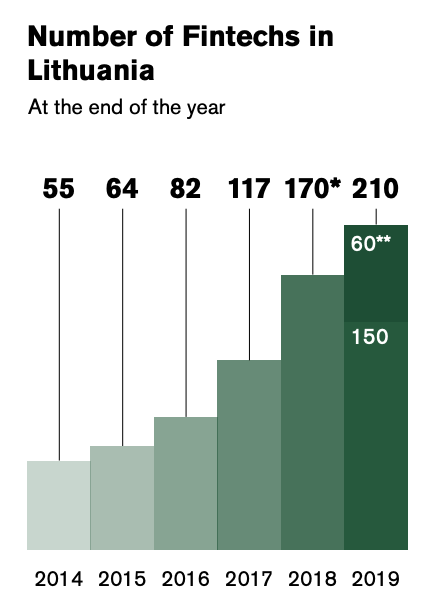

2019 was a key year for Lithuania’s fintech sector, with the number of companies in the sector rising to more than 200 and the country being recognized as one of the most dynamic fintech hubs globally, according to a new report by Invest Lithuania, the Lithuanian investment promotion agency.

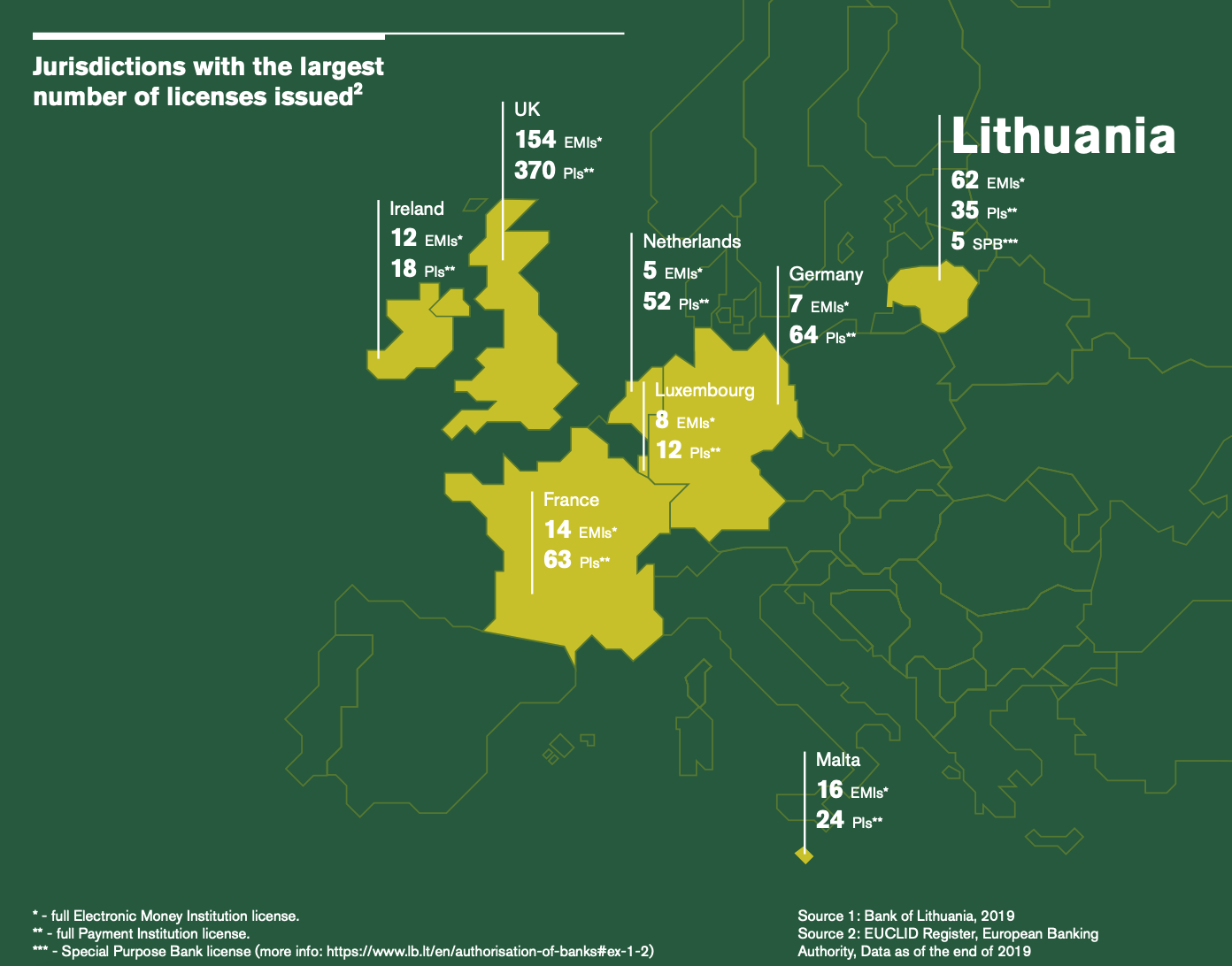

Lithuania is now home to 210 fintech companies, a 24% increase compared with the previous year, and has issued 102 licenses going towards electronic money institutions (EMIs), payment institutions, and so-called special purpose banks. In 2019, the number of people employed by companies in the sector rose 30% to 3,400.

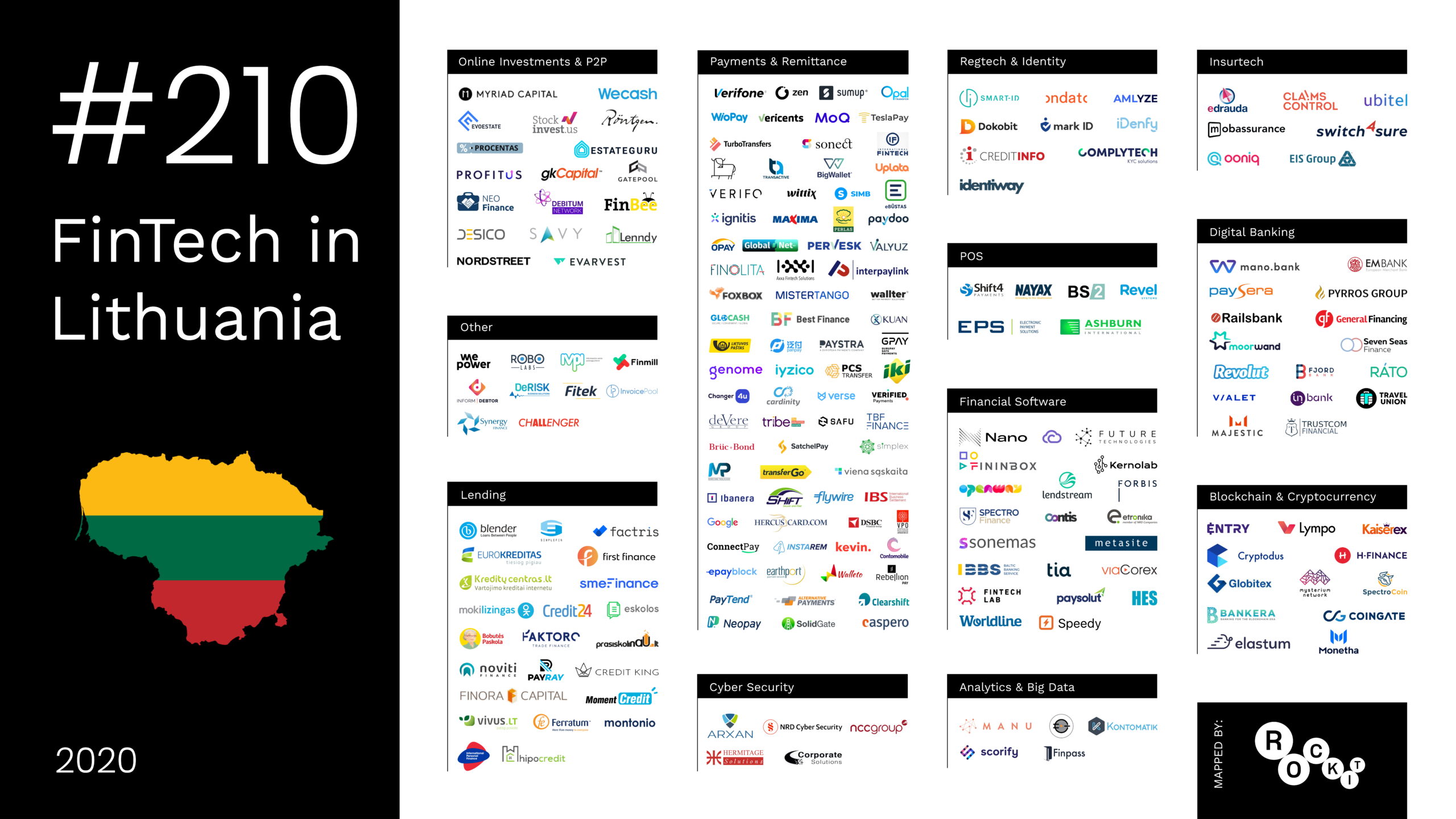

Lithuania’s Fintech Hub at a Glance, The Fintech Landscape in Lithuania 2019-2020 Report, Invest Lithuania

The figures make Lithuania the second largest fintech hub in Europe by number of licensed companies, only behind the UK, and the largest within the EU, the report says.

Jurisdictions with the latest number of licensed issued, The Fintech Landscape in Lithuania 2019-2020 Report, Invest Lithuania

Lithuania’s fintech startups

The rapid growth of Lithuania’s fintech ecosystem began in 2016, and since then, the average annual growth has been around 30%.

Number of Fintechs in Lithuania, The Fintech Landscape in Lithuania 2019-2020 Report, Invest Lithuania

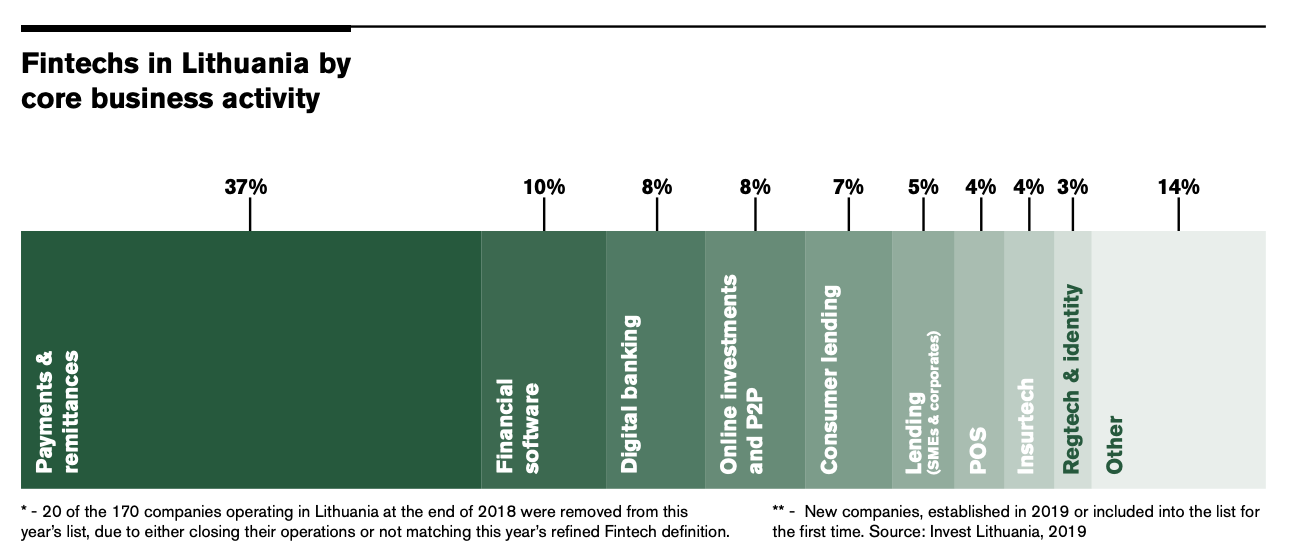

Today, Lithuania’s fintech startups cover all major segments of fintech, including payments, wealthtech, regtech and digital identity, insurtech, digital banking, and blockchain.

Payments and remittance is the most crowded segment within Lithuania’s fintech startups ecosystem with 78 companies (37%). Other developed segments include financial software (10%), digital banking (8%), online investment and peer-to-peer (P2P) lending (8%), and consumer lending (7%).

Fintechs in Lithuania by core business activity, The Fintech Landscape in Lithuania 2019-2020 Report, Invest Lithuania

Local fintech leaders in Lithuania include FinBee, a P2P lending platform, Fininbox, a banking system provider, Mano Bankas, the first licensed digital bank in Lithuania, MoQ, a mobile payments platform, NEO Finance, a P2P lending platform, Paysera, an EMI, Profitus, a real estate crowdfunding platform, Savy, a P2P online lending marketplace, and SME Finance, which provides business funding solutions through invoice finance and business loans.

2019 also saw Lithuania gain further international recognition as a fintech hub with a 50% growth in the number of foreign companies establishing an office in the Baltic country. Several of these international fintechs have expanded both the size of their teams and the range of functions that are carried out in their Lithuanian offices, the report says.

Currently, international fintechs in Lithuania include Blender, a P2P lending platform from Israel, Contis, a UK-based provider of end-to-end banking and payments solutions, deVere, a wealthtech company headquartered in Dubai, Earthport, a cross-border payments services provider from the UK, Factris, a provider of working capital to SMEs from the Netherlands, Sonect, a Swiss payments startup specialized in virtual ATMs, Flywire, a payments company from the US, and SumUp, a London-based mobile payments company.

Lithuania’s fintech industry

Invest Lithuania, which conducted a research in collaboration with fintech hub Rockit Vilnius, found that fintech teams in Lithuania are multinational with 39% of respondents reporting to have international team members working in their Lithuanian offices.

Fintech teams are also diverse in terms of gender with 51% of surveyed fintechs reporting to have one or more female executives in their Lithuanian office.

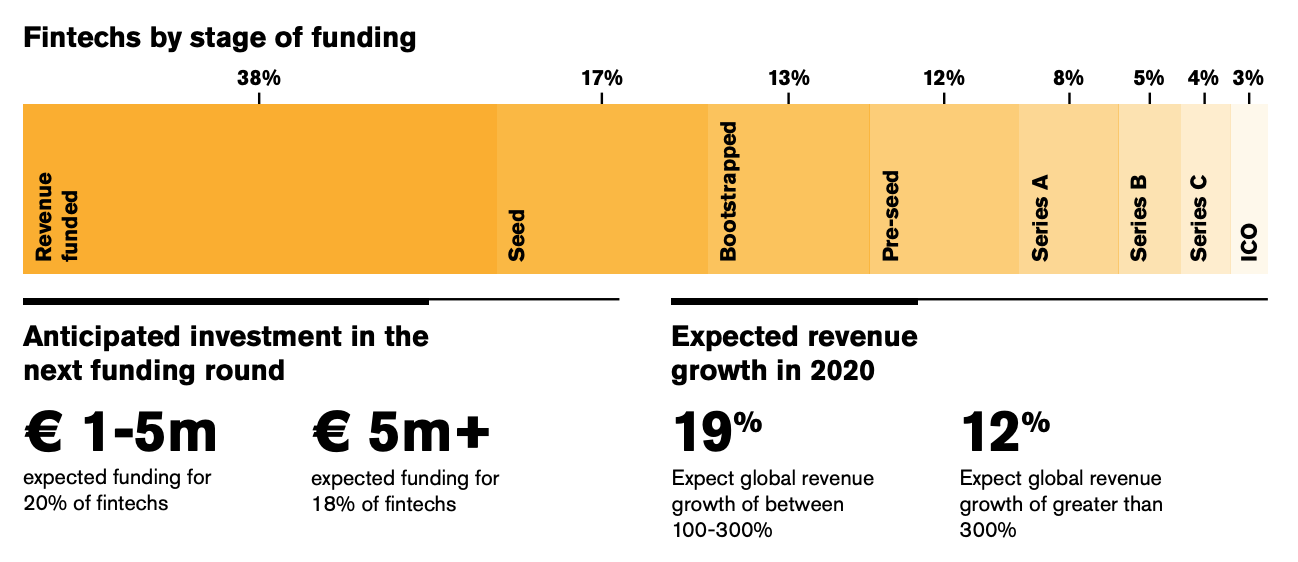

The study also found that 13% of surveyed fintechs are bootstrapped, and 38% are financing their growth using their own revenue rather than capital from investors. Nevertheless, many still use external funding with 17% having raised funds through Series A-C funding rounds and 29% having received pre-seed and seed money.

Over the coming year, around a fifth of fintechs expect to raise at least EUR 5 million and 16% expect to raise between EUR 1 to EUR 3 million. Over half of the companies predict strong growth in revenues in 2020.

Fintechs by stage of funding, anticipated investment and expected revenue, The Fintech Landscape in Lithuania 2019-2020 Report, Invest Lithuania

Fintech in Lithuania in 2020 and onward

In 2020, the number of fintech companies in Lithuania is expected to rise to 250 with segments including digital banking and personal finance, as well as trends like Open Banking, set to witness strong growth. Fintech is expected to create more than 1,000 new jobs, according to the research.

Additionally, new regulations and initiatives from the government are expected to arrive in 2020 and should make the sector more robust and competitive. For example, the Bank of Lithuania is currently building a new framework for addressing risks posed by the provision of digital financial services, striving for risk-based and near real-time insights-based supervision, the report notes, as well as new sandboxes.

For a full list of all Fintech Lithuania companies, you can check out our list here.