The Bank of Lithuania Starts Adding Fintech Companies’ Innovations on the Blockchain

by Fintechnews Baltic June 26, 2019LBChain is the world’s first blockchain-based sandbox developed by a financial market regulator, the Bank of Lithuania.

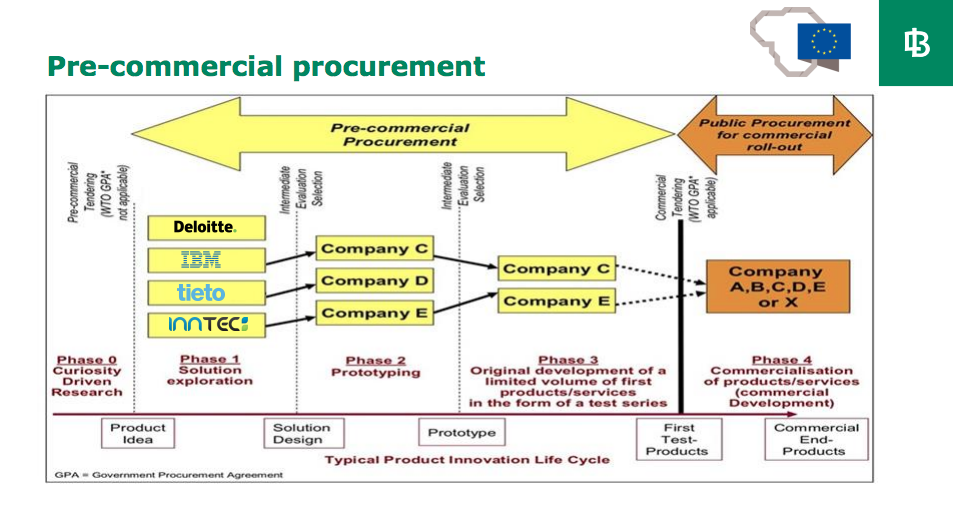

The platform was developed through a pre-commercial procurement and is now opening up to international start-ups as well as financial and FinTech companies to test their solutions on the LBChain. The project combines the creation of innovative blockchain-based solutions with supporting their application in the financial sector as well as improving the quality of regulatory requirements and attracting foreign direct investment.

To create the LBChain platform, the Bank of Lithuania invoked last year service providers selected through a pre-commercial procurement. The LBChain project is divided into three stages. After the first design stage, the Bank of Lithuania has selected three: Deloitte (IE), IBM (PL) and Tieto (LT).

During the second development stage, the three service providers will be working on two tasks. First, they will join forces with the selected FinTech companies to create the LBChain platform. Second, together with the Bank of Lithuania, they will consult the FinTech companies on developing a specific blockchain-based product that would meet their needs. The FinTech companies will then be able to test this product within the LBChain environment in the third stage.

Pre-commercial procurement

The LBChain project has garnered significant attention among European FinTech companies: with 21 registrations from countries such as Belgium, Poland, Lithuania, the Netherlands, Finland, Serbia and Sweden, no more than 6 applicants will be deemed eligible to move forward.

Andrius Adamonis

“The initiative of the Bank of Lithuania to develop blockchain-based products and solutions has been well received. This is also evidenced by the rather considerable amount of applications that were sent in,”

said Andrius Adamonis, Project Manager at the Bank of Lithuania.

Fintech companies eligible to move to the second development stage were announced by mid-March 2019. Working together with the three LBChain service providers, they will contribute to the development of the LBChain platform as well as build a prototype of their envisaged product, both of which will be later tested with a focus group. Companies that will not be selected for the second stage of the project will be able to join the LBChain focus group. They will also be able to register to the third stage, which will start in September 2019, where FinTech companies will create and test their products within the LBChain environment.

Featured image credit: Bank of Lithuania