Bank of Lithuania Reports Digital Payments Pace Accelerating Despite COVID-19

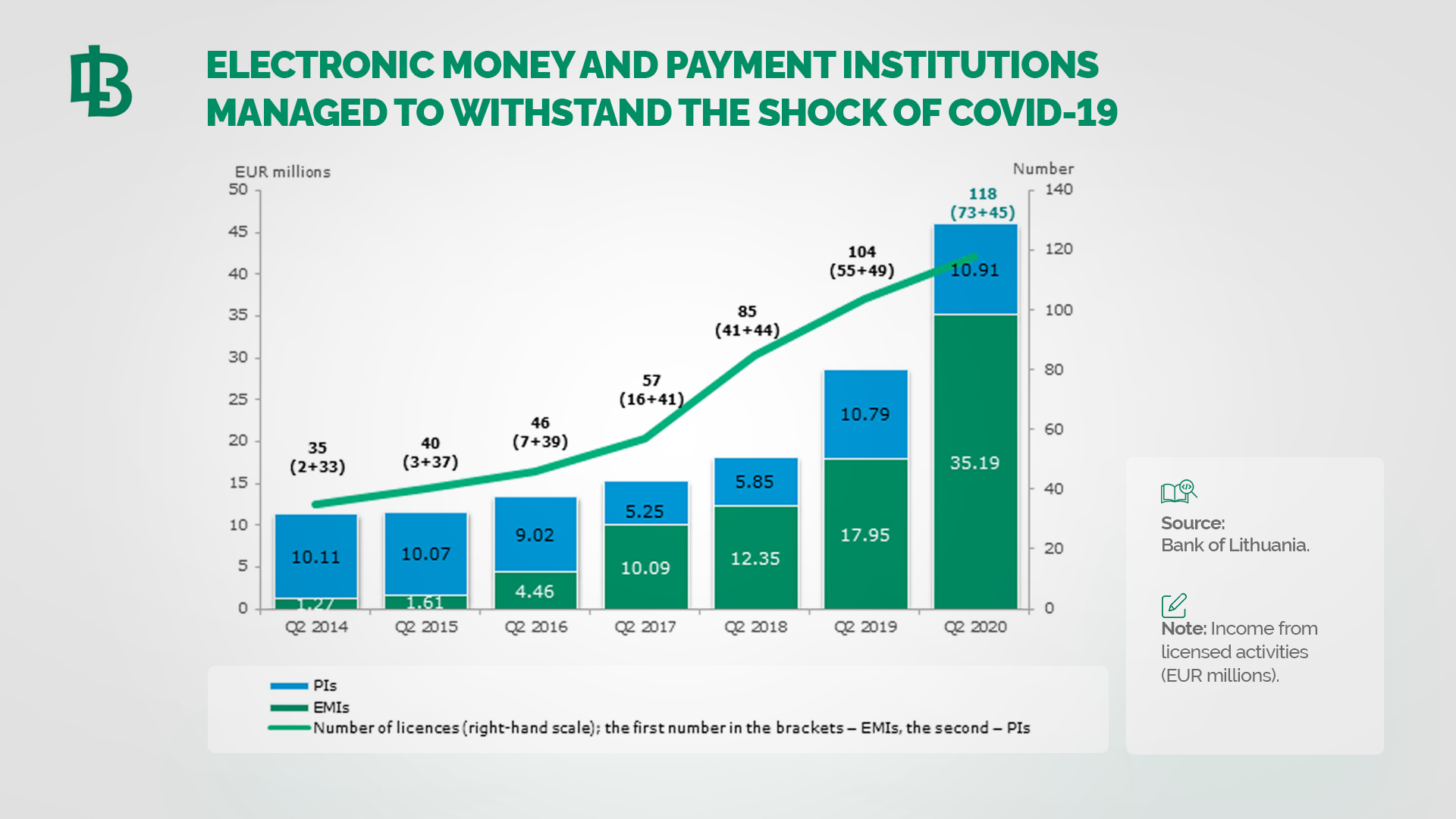

by Fintechnews Baltic September 28, 2020In the first half of 2020, the number of payment transactions and income of electronic money and payment institutions (EMIs/PIs) has continued to grow at a rapid pace despite the pandemic.

Rūta Merkevičiūtė

“The trends observed in the first half of the year show that the EMI/PI sector has withstood the shock of COVID-19. On top of that, the sector’s performance has even improved along with the digitalisation of payment services,”

said Rūta Merkevičiūtė, Head of the Electronic Money and Payment Institutions Supervision Division at the Bank of Lithuania.

In the first half of 2020, the total amount of payment transactions executed by EMIs and PIs stood at €22.4 billion. On a year-on-year basis, this amount grew 1.4 times, while during the reporting quarter – by nearly 17%.

EMIs and PIs received €46.1 million in income from licensed activities – an increase of €17.4 million (1.6 times) compared to the first half of 2019: income generated by PIs remained broadly unchanged (up by 1%), while the share earned by EMIs has almost doubled.

At the end of the first half of 2020, the public list of EMIs and PIs included 118 licensed entities and currently examining a total of 38 licensing applications.

In 2021, the Bank of Lithuania is expected to receive up to 100 new applications for an EMI or PI license.

The Bank of Lithuania notes that EMIs and PIs must find balance between compliance with legal requirements and their business development, yet keep in mind that compliance should always be prioritised.

The financial performance indicators for the first half of 2020 show that 3 institutions (compared to 9 out of 117 institutions in the first quarter of the year) failed to comply with the minimum own funds requirements. 2 of them have already taken steps to ensure a sufficient amount of own funds by accumulating additional capital buffers and taking decisions to increase their authorised capital.

Featured image credit: Card photo created by wayhomestudio – www.freepik.com

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.