Spell has partnered with Luminor to support them in growing their payments business across the Baltic region. Spell’s white-label platform will enable Luminor’s processing center to accelerate payment processes and significantly scale its volume of payments.

Justas Noreika

“Luminor is delighted to partner with Spell. With their support, we are able to significantly scale our payments operations, effectively allowing us to compete with advanced fintechs in terms of speed and efficiency. It is important for us to have an agile, flexible and future-proof solution, and Spell’s platform hits all of these requirements,”

said Justas Noreika, Head of Acquiring and E-commerce at Luminor.

Noreika added that such solutions are especially crucial during the current pandemic, with the shift towards business moving online.

“We are glad to support our customers now and going forward, in a more user friendly and safe way.”

Jevgenijs Novickis

“We are extremely pleased to partner with Luminor. Having quickly deployed our platform, Luminor is able to update its e-commerce offering with a wider range of payment scenarios and methods. Our platform is also automating Luminor’s payments processes. Together, these improvements are helping Luminor increase the speed at which it operates and ultimately grow its volume of payments,”

said Spell co-founder and CEO Jevgenijs Novickis.

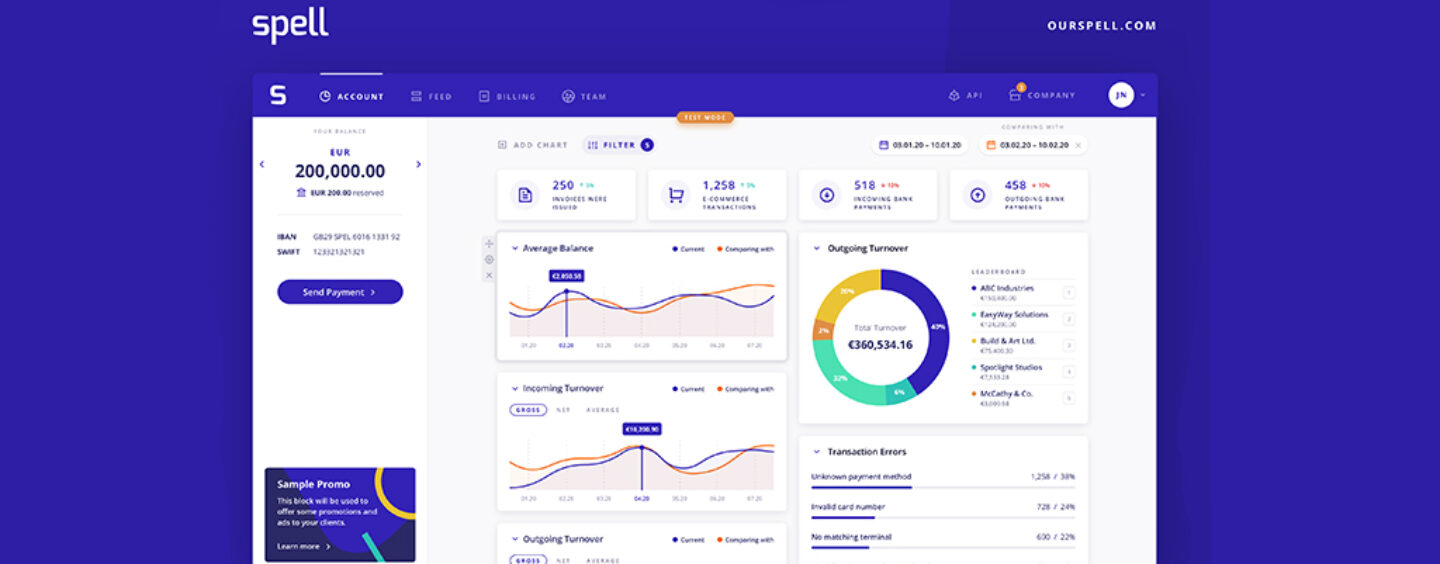

Spell bridges the technological gap between incumbent payment institutions and fintechs. Within a matter of days, Spell can help banks or PSPs to reach a level of automation comparable to the most advanced fintechs. They are able to handle a much wider range of payment scenarios and can scale the volume of payments processed while growing profit margins per account. As a result, these institutions are able to increase their turnover, grow rapidly while retaining healthy profit margins, and be more effective in handling financial relationships with clients.

Spell’s platform unites bank payments, ecommerce payments and billing into one, and is powered by a back-office system with a number of features that help clients boost growth. These include automation of routine tasks, performance reporting, team workload management, and a live feed of payments and compliance and information requests.

“We see Spell as a Formula 1 pit stop for payment businesses, where they can update their vehicle at light-speed and get back on track to win the race.”

explains Novickis.

Throughout 2020, Spell will look to expand internationally to serve payment institutions from across the world. Singapore is on Spell’s radar for its next steps.