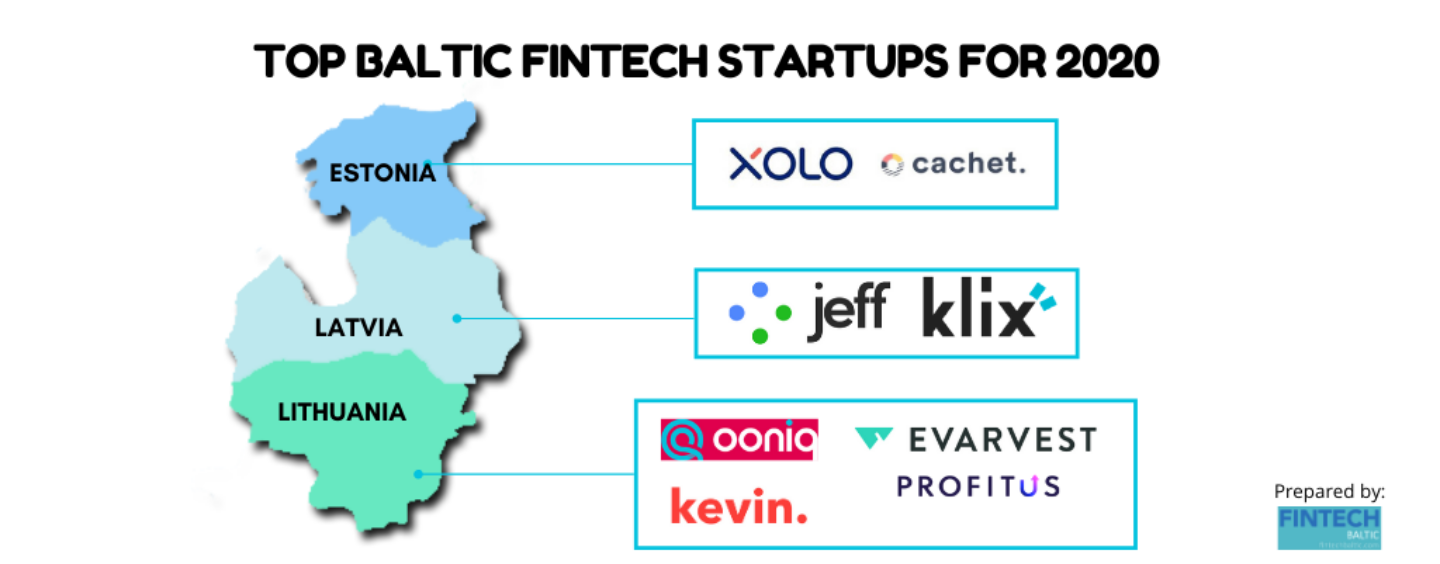

The fintech sector in the Baltic states is rapidly growing on the back of proactive governments that have set sights on establishing a favorable environment for the industry to thrive.

Lithuania launched a regulatory sandbox in 2017 to allow fintechs and financial services companies to test out innovative products, Estonia, the birthplace of some of the world’s leading fintechs including TransferWise and Guardtime, has embraced blockchain and electronic ID, and Latvia have seen its fintech industry grow steadily over the past years with several of its startups, including Mintos and Twino, expanding rapidly across the region.

With fintech gaining speed in the Baltics, we look today at eight exciting fintech startups in the region to keep an eye on in 2020. Several of them are rather newcomers but have nevertheless gained significant traction in 2019, either by signing new partners or by raising funding from notable investors.

Lithuania

Ooniq

Founded in early 2018 and based in Vilnius, Ooniq is a peer-to-peer (P2P) insurance platform operated by Lithuanian company UAB Workpower. Ooniq offers an alternative for people who can’t afford the expensive services of traditional tech insurance providers by allowing groups of friends to come together to collectively protect the belongings they love.

All transactions on Ooniq are secured with blockchain technology, there are no long-term contracts, and all decisions are made by consensus from the community. New members have to be approved, and leftover funds are equally split among the group.

In June 2019, UAB Workpower became the first company to join the Bank of Lithuania’s regulatory sandbox. Last year, it raised an undisclosed amount in seed funding, according to Crunchbase, and also joined the Hong Kong-based Helix Accelerator program.

Profitus

![]()

Launched in mid-2018 and headquartered in Vilnius, Profitus is a real estate investment platform that allows users to start investing with as little as 100 EUR. The platform brings together people who want to invest in real estate and people looking for money to develop their real estate idea.

Profitus collects money from investors and then funds the real estate project. The investment is protected by the pledged assets of the project owner.

In 2019, the startup completed a trial within the Vilnius-based Realbox Proptech sandbox, which allowed it to expand its network of investors, mentors and customers, and grow brand reputation in a short amount of time, and raised a EUR 300,000 in seed funding.

Evarvest

![]()

Headquartered Vilnius and founded in early 2018, Evarvest is a fintech startup developing a platform that brings together more than 30 of world’s stock exchanges to make it easier for users to invest.

The Evarvest app, which has yet to launch, promises to provide its users with an easy, inexpensive and safe way to invest in more than 9,000 stocks, including some of the world’s most recognizable brands they know, love and trust.

The startup has already been recognized in a number of prestigious fintech contests, such as the Barclays Rise Vilnius 2018 Fintech Week Pitch Competition, and FintechInn Conference 2018 Pitch Battle, and has reached over 28,000 unique active subscribers on its app waitlist.

Evarvest is currently applying for a financial brokerage license authorization from the Bank of Lithuania, and aims to first create its global leading investment platform before expanding its product portfolio into further financial products, such as retirement savings.

Kevin

Founded in 2017 and based in Vilnius, Kevin is a licensed payment institution focused on solutions based on the PSD2 directive with a vision to become a link between banks, customers and fintech companies.

The startup currently provides a platform connecting all financial market players, allowing banks to connect to new services for their customers, and enabling market participants to develop products for regulated market without getting licenses first.

Kevin has been closely cooperating with the Baltic Institute of Advanced Technology on financial behavior analysis to provide alternative credit pre-scoring, personal financial health and AML/fraud prevention solutions.

According to Crunchbase, Kevin raised EUR 350,000 in a seed funding in December 2019.

Estonia

Cachet

Founded in 2018 and based in Tallinn, Cachet is an insurtech startup providing a consumption-based insurance platform and wallet focused on gig economy service providers. The platform works based on a business-to-business-to-customer (B2B2C) model, onboarding customers and selling them policies that are issued together with Cachet’s insurance partner BTA, Vienna Group.

Cachet onboarded Uber in Estonia as a client in 2019. This year, the startup entered the Latvian market through partnerships with ride-sharing services providers Bolt and Yandex Taxi to provide them with personalized insurance for their drivers,

Cachet has raised EUR 300,000 in seed funding so far, according to Crunchbase, the latest round being in January 2020.

Xolo

Founded in 2015 and based in Tallinn, Xolo, formerly LeapIN, is an all-in-one software-as-a-service (SaaS) platform for solopreneurs, bringing together banking, company formation, accounting and compliance. The startup’s mission is to reduce time spent on business administration to near zero by offering an incredibly simple online platform that merges all key administrative functions.

Xolo’s largest markets are currently Germany, Spain, France, the UK, Ukraine, and Turkey, where it serves software developers, management consultants, designers, or other independent professionals.

Xolo has raised EUR 7.9 million in funding so far, according to Crunchbase, the latest round being a EUR 6 million Series A in July 2019. In March 2020, the startup launched a business banking offering for e-Residents of Estonia.

Latvia

Jeff App

Launched in Riga in the summer of 2019, Jeff App offers a loan brokerage solution which utilizes alternative data. The startup has created a solution similar to the Tinder dating app that brings together people looking for various financial services with financial services providers.

Jeff App was one of the winners of the Central and Eastern European regional Seedstars Summit competition earlier this year and was recognized as one of the 20 best startups in Latvia.

Jeff App raised EUR 150,000 in January 2020 to enter the Vietnamese market and plans to expand to Indonesia later this year. The company is currently hiring product, marketing and IT specialists in Riga and Ho Chi Minh City (HCMC), Vietnam. As of January 2020, it claimed it had almost 10,000 users, and had grown its team from two people in mid-2019 to ten people between Riga and HCMC.

Klix

Klix is a new payments startup that provides a universal login system for e-commerce checkouts. The solution aims to streamline the checkout experience for online shoppers but allowing users to conveniently use their previously-stored checkout details, including payment information and delivery address. Any e-commerce site can implement Klix in their checkout process.

Klix was launched in 2019 by Raimonds Kulbergs, the founder of fundraising startup Funderful, which he led in early 2019 to a successful exit.

Backed by Citadele Bank, Klix started with Latvia as its sandbox and will be expanding across the Baltics this year, with the goal to go for the “entire time zone” in the near future, Kulbergs told Labs of Latvia. Moving forward, the plan is to add more features such as split payments, he said.