Posts From Fintechnews Baltic

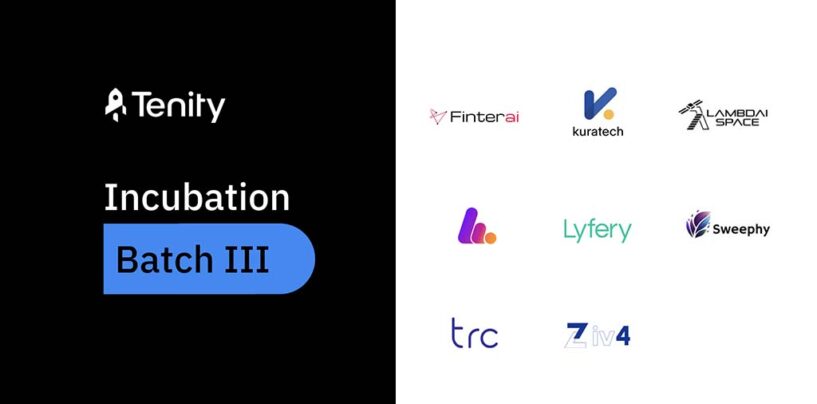

Tenity to Invest in 4 Early-Stage Fintech Startups in Estonia and 2 From the Nordics

8 early-stage startups from 5 countries have been selected for the upcoming Tenity Incubation Program starting on March 4th, 2024, in Tallinn. The selected startups receive an initial EUR50k investment from the Tenity Incubation Fund. The upcoming edition of the

Read MoreSweden’s Capitalbox Acquires Denmark’s Invoice Purchasing SME Specialist Omniveta

CapitalBox, the Stockholm based alternative financing specialist for small- and medium-sized enterprises (SMEs), announced its acquisition of Copenhagen-based Omniveta Finance. Omniveta is an invoice purchasing company dedicated to improving lending liquidity for SMEs across Denmark. Founded in 2012, Omniveta specialises

Read MoreOpenfin Hack International Fintech Hackathon Opens for Applications

Leading financial institutions, Fintech companies, and Latvian and European financial industry associations opens application opportunities for the international Fintech hackathon “OpenFin Hack”, which aims to promote innovation to make financial services more secure, inclusive and accessible. The OpenFin Hack hackathon

Read MoreLatvia’s Fintech Industry on the Rise, Driven by Growth in Blockchain, Digital Lending, Regtech

Latvia is home to a dynamic fintech industry that’s witnessing remarkable growth in the blockchain and digital lending sectors. Additionally, the rise of regtech solutions is being driven by the need to comply to heightened regulatory requirements, offering opportunities for

Read MoreŠiaulių Bankas Selects Temenos to Modernize Core Banking in the Cloud

Temenos announced that Šiaulių Bankas, the largest independently-owned bank in Lithuania with over €4 billion in assets, has selected Temenos to modernize its core banking platform. Šiaulių Bankas will migrate its retail and corporate banking including trade finance to Temenos

Read MoreFintech Funding in Lithuania Nosedives 97% YoY

In 2023, Lithuania fintech startups secured a mere EUR 7.2 million in venture capital (VC) funding, a figure which represents a staggering 97% year-on-year (YoY) decline from EUR 222.6 million, new data released by Dealroom show. The sum makes fintech

Read More6 Lithuanian Fintech Startups to Watch in 2024

Over the past years, Lithuania has emerged as a significant player in the European fintech sector, an industry that has grown on the back of a burgeoning startup ecosystem, a favorable regulatory environment and robust infrastructure. As of the end

Read MoreCore Banking Provider Tuum Grabs 25M EUR Series B Led by Commerzventures

Tuum, a Tallinn and London based core banking provider, announced that it has raised EUR25m, in a series B financing round led by CommerzVentures, with participation from Speedinvest alongside existing investors. Tuum has expanded rapidly since signing its first client

Read MoreTransferGo Strengthens Leadership Team for Global Expansion

TransferGo, a global fintech creating a fairer world for millions of hard-working migrants, announced the addition of three professionals to its executive team to spearhead global expansion and consolidate its presence in existing markets. With their extensive experience and expertise,

Read MoreTop 14 Fintech Events in the Baltics and the Nordics to Attend in H1 2024

Over the years, the Nordic and Baltic regions have emerged as vibrant hubs for fintech innovation, fueled and facilitated by advanced digital infrastructure and digitally literate populations, government support, and strong collaboration between traditional financial institutions, startups and technology companies.

Read More