Alternative Banking Systems and Fintech Products for Digital Nomads

by Fintechnews Baltic August 10, 2022For digital nomads who travel internationally and on a regular basis, finding a banking solution that fits with their unique lifestyle can be a daunting task.

Digital nomads travel the world and often live in several different countries with their own unique banking system and requirements. This means that going the traditional route would imply navigating those local banking systems, and having to endure tedious onboarding processes that require applicants to travel in-person to a branch, and present a bunch of paper documents each time.

At the other end of the spectrum, there are those who use traditional banking services from their country of origin, an option which oftentimes result in costly fees considering the extra charges applied when using their cards aboard and foreign exchange.

Because of these difficulties, many digital nomads are turning to alternative banking systems and digital banks that offer more flexibility, services that can be accessed digitally, and cheaper prices.

These solutions are often more appropriate for a digital nomad’s lifestyle since they are easily and more widely accessible than traditional banks, supporting advanced digital features and capabilities like electronic know-your-customer (eKYC), multiple digital payment and transfer options, real-time finance management, as well as card management right from the app.

In addition, because fintech companies and digital banks are tech-focused and tend to prioritize providing great customer experiences, their solutions are generally more intuitive and seamless, with customer support working around the clock to resolve any query completely remotely and in a timely manner.

Choosing a banking and fintech solution

Choosing the right digital banking provider takes careful consideration. For a personal banking product, things to keep in mind include one’s tax residency, the country they reside in, their citizenship and their exact needs. Plus they’ll want to compare rates, monthly fees and transactional charges, services and accessibility, as well as decide whether they’ll be needed specific online banking solutions like personal finance and budgeting, as well as integration with third-party providers.

For business banking needs, the choice of a bank will mainly depend on where the business is based. For example, for a business based in the European Union (EU), opting for a fintech or digital bank based in the region would be the most logical, appropriate and affordable option.

For digital nomads who have applied for the Estonian e-Residency program, they may also be eligible to use an Estonian bank or a EU bank, in addition to all the fintech providers serving the market.

Estonian banks are known for their wide range of online banking services, and one would simply need to use their e-resident digital ID card to manage all their business banking transactions and services from anywhere. An Estonian bank would typically require the customer to make at least one personal visit to their branch offices for identity verification and KYC obligations.

Best digital banking options for digital nomads

The e-Residency Marketplace is a service put in place by the Estonian government. The platform provides basic information about some of the service providers in the e-Residency ecosystem and which support e-residents in launching, running and growing their businesses.

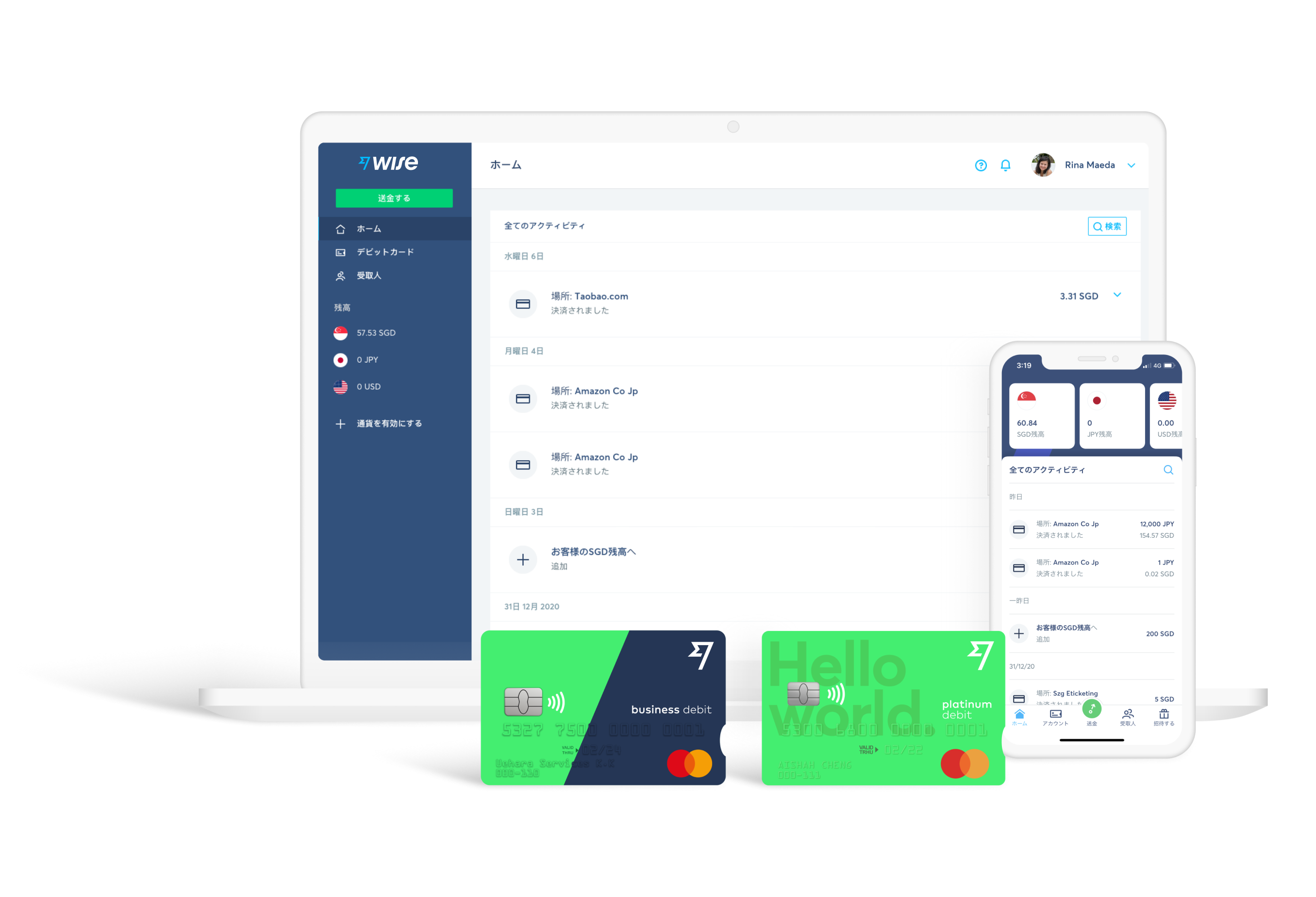

One provider featured in the Marketplace is Wise. The UK-headquartered fintech company started out as an international transfer business before expanding to accounts and payment cards. Today, Wise provides an online account that lets customers send money, get paid, and spend money internationally, applying cheaper fees than traditional international transfer businesses.

Users can hold more than 50 currencies in their account, convert currencies instantly through the app and get account details to receive money in ten different currencies. They can also order a Wise card right from the app, which would then allow them to make in-store purchases and payments.

Wise is perhaps one of the best options out there for anyone who needs to spend, receive or send money internationally, and anyone that deals with more than one currency on their daily basis.

Wise online account and card, Source: Wise

Another option for digital nomads is Revolut. Revolut is a digital bank headquartered in the UK. It offers one of the most extensive portfolio of products in the market, providing banking services including GBP and EUR bank accounts, debit cards, fee-free currency exchange, stock trading, cryptocurrency exchange, peer-to-peer payments, and more.

Revolut supports spending and ATM withdrawals in over 200 countries and transfers in more than 30 currencies directly from the app.

Revolut dashboard and card, Source: Revolut

N26 is a German mobile-first bank that allows customers to manage their money in real-time from their smartphone. Customers can open an account online in just a few minutes, and get a free virtual Mastercard from the jump.

N26 doesn’t charge any maintenance fee, foreign transaction fee, nor does it require minimum deposit amount. The digital bank operates across 24 markets, serving 7 million customers with products like bank accounts, payment cards, overdraft, investment products and insurance coverage.

N26 bank account and card, Source: N26

Featured image credit: Pexels

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.