In Europe, Nordic Countries Have the Most Advanced Open Banking Ecosystems

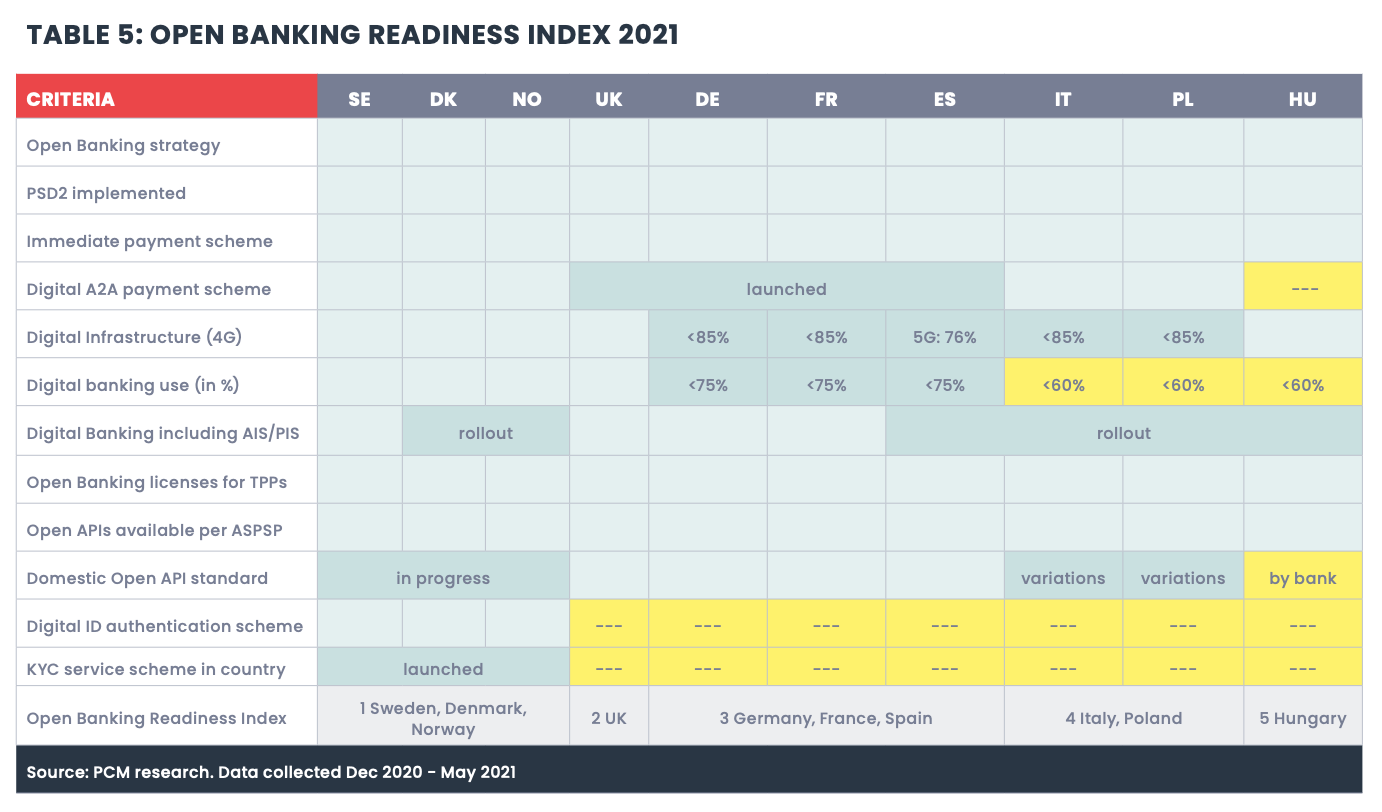

by Fintechnews Baltic July 28, 2021In Europe, the Nordic countries of Sweden, Denmark and Norway have the most advanced open banking ecosystems. Trailblazing regional regulatory regimes, highly developed digital infrastructures, and a pan-Nordic collaborative approach have enabled these countries to take the lead over the rest of Europe, a new research by Mastercard found.

The report, titled Open Banking Readiness Index: The Future of Open Banking in Europe, explores the status of open banking in ten selected European markets, and found that across Europe, Sweden, Denmark and Norway are at the forefront of the open banking movement.

To date, they are the only countries in Europe where established digital ID authentication and know-your-customer (KYC) services at a pan-Nordic level are part of the open banking strategy. Not only that, but the Nordic region is also leading in digital payment services with notably the P27 initiative, which seeks to develop a real-time, cross-border payment infrastructure.

Open Banking Readiness Index 2021, Source: Open Banking Readiness Index: The Future of Open Banking in Europe, Mastercard

P27: real-time, cross-border payments for the Nordic region

In February 2018, a group of major Swedish, Danish and Finnish banks teamed up to explore the possibility of creating a pan-Nordic, real-time, cross-border payment infrastructure.

The P27 project – called so for the 27 million people residing in Sweden, Norway, Denmark, and Finland – aims to create a digital platform for businesses and consumers to make real-time, cross-border payments to one another, supporting immediate payment clearing and account settlement, regardless of currency.

P27’s mission is to make payments more efficient and bring further harmonization to the European payments landscape. It also represents an effort to raise the technology competence of participating banks against the wave of global tech giants entering the financial services space.

P27 is expected to launch later this year.

Invidem: the Nordics’ KYC utility provider

Another pan-Nordic collaborative effort that has put the region at the forefront of open banking is Invidem, a KYC infrastructure.

Initiated in June 2018 by six Nordic banks, Invidem aims to create a secure and cost-effective Nordic KYC infrastructure that allows Nordic banks and financial institutions to access reliable basic KYC information and data.

Invidem, which is slated to launch commercially later this year, will provide a common Nordic platform based on advanced data management technologies to enhance the collection and management of bank customer information.

Although the primary goal is to enhance data competence and support basic functions of KYC work, Invidem also aims to help the Nordic countries stay ahead of global technology giants, just like the P27 project.

Invidem is owned by the founding banks, but it will also be offering its services to third parties.

Digitally-savvy consumers

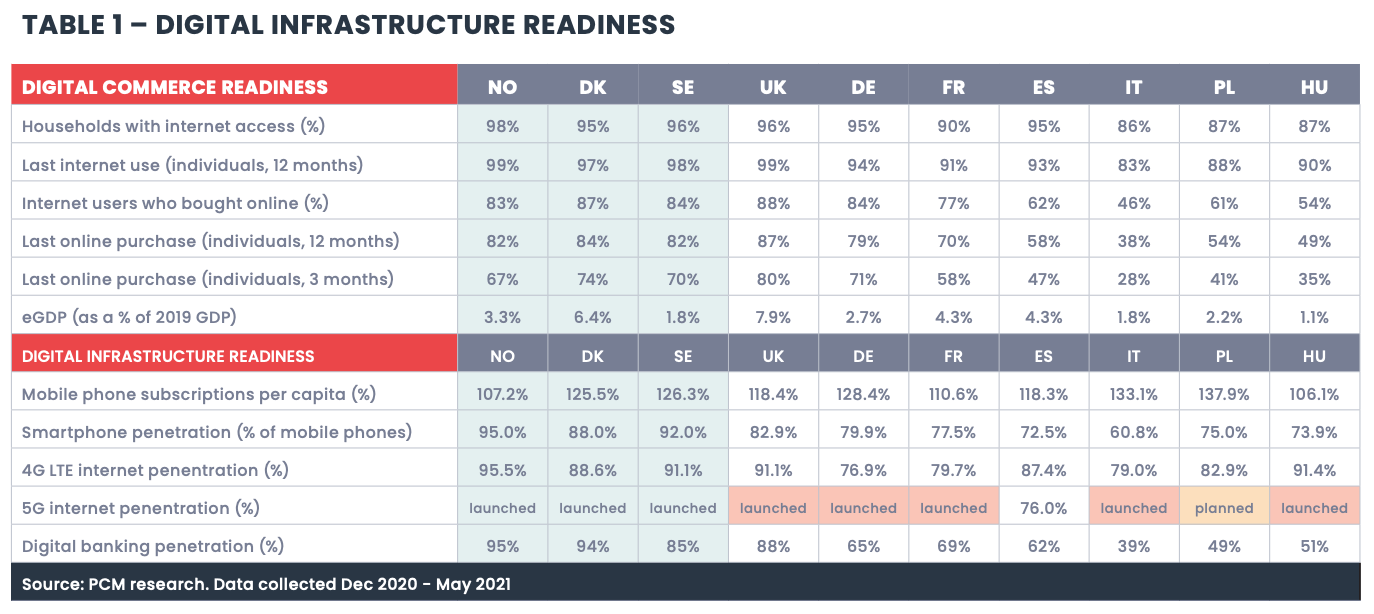

Not only does the Nordic region have one of Europe’s most modern and advanced open banking and digital payments ecosystems, the region is also leading in consumer readiness and digital adoption.

In particular, Norway is home to Europe’s most digitally-savvy consumers, boasting the highest Internet penetration, with 98% of households connected, and the highest digital banking penetration, with 95% of 14-76 year old use digital banking.

Digital Infrastructure Readiness, Source: Open Banking Readiness Index: The Future of Open Banking in Europe, Mastercard

After the Nordics, the Mastercard report names the UK for having the second most developed open banking ecosystem, recognizing the country for its burgeoning tech landscape comprising some 294 fintech companies and payment service providers, among which 102 live offerings.

Citing data from the Open Banking Implementation Entity (OBIE), the report notes that more than 3 million UK consumers and businesses are using open banking-enabled products to manage their finances, access credit and make payments.

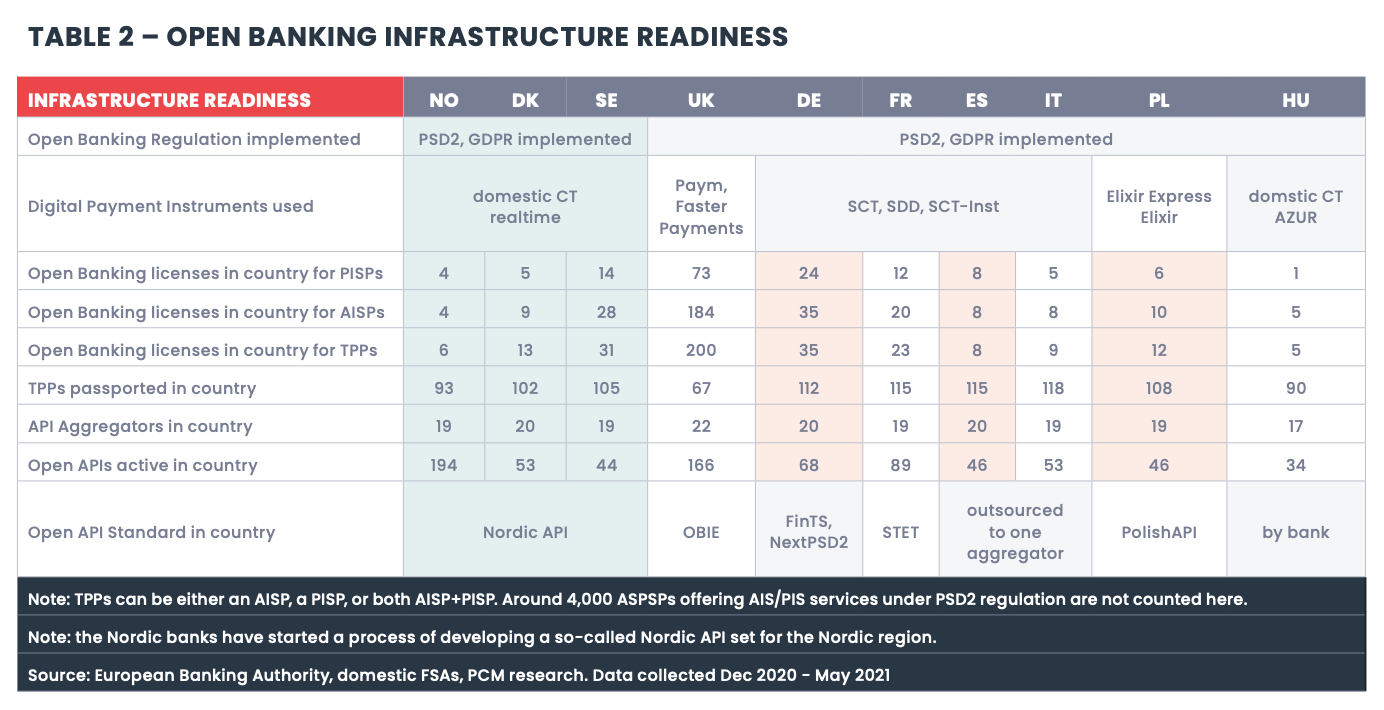

Overall, the report says that open banking implementation in Europe has gained significant momentum with some 450 open banking licenses for third-party providers (TPPs) registered across the region as of December 31, 2020, up 10% since the end of October 2020.

But significant differences between European countries exist, not only in terms of digital adoption, but also in the way they approach open banking.

For example, Germany has opted for a collaborative approach towards open banking development which has been articulated around interbank-collaboration between various tiers of savings, cooperative, and commercial banks.

Meanwhile, in Hungary, open banking has largely been dominated by foreign banks, all of which with their own approach. Hungary is currently the only country of the lot that doesn’t have a domestic open banking API standard, nor has it opted for an aggregator-supported open banking API model.

Open Banking Infrastructure Readiness, Source: Open Banking Readiness Index: The Future of Open Banking in Europe, Mastercard

The research also shows a fragmented open banking market with a high number of open banking API sets used across Europe. Though most countries have their own domestic open banking API standards, a single pan-European open banking API standard is still missing, posing connectivity and harmonization challenges, the report says.

Featured image: edited from Unsplash

4 Comments so far

Jump into a conversation