Bank of Lithuania Provides Recommendations on Raising Capital Through STOs

by Company Announcement October 21, 2019The Bank of Lithuania has issued the Guidelines on Security Token Offering (STO) which provide greater regulatory clarity and aim at higher investor protection.

Marius Jurgilas

“The current focus on security token offerings is taking over the waning interest in initial coin offerings (ICOs). Businesses are interested in this particular way of raising capital as an alternative to bank lending. The Guidelines on Security Token Offering are aimed at explaining our position in this regard rather than creating new regulatory arrangements. In a strict regulatory environment, such as the securities market, it becomes crucial to set rules in order to avoid any miscommunication, misunderstandings and their consequences,”

said Marius Jurgilas, Member of the Board of the Bank of Lithuania.

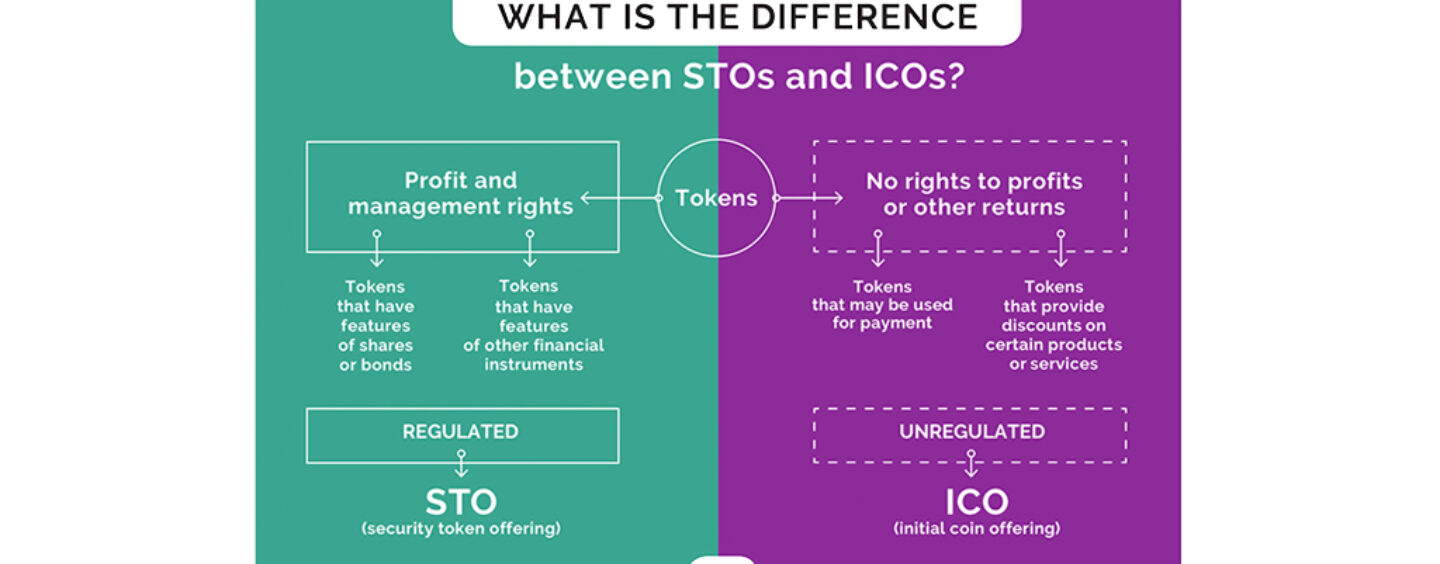

The Bank of Lithuania has become one of the first market regulators in the world to issue guidelines on STOs. Previously, it has also published (and later updated) its position on ICOs. Setting forth the regulatory approach of the Bank of Lithuania to tokens as a financial instrument, the new Guidelines focus on their classification (what tokens should be categorised as having features of securities or other financial instruments), assess specific cases, provide recommendations related to the issue of security tokens and clarify applicable legal regulation.

Companies planning to use the STO method for issuing tokens qualified as transferable securities or other financial instruments will have to comply with EU and national legislation regulating capital-raising activities.

“In case market participants are not sure whether their offered tokens are subject to regulation, we stand ready to provide them with consultation on this matter,”

said Mr Jurgilas.

While drawing up the Guidelines, the Bank of Lithuania initiated two public consultations with market participants, took into account some of the received suggestions and provided the needed explanations. The Bank of Lithuania has decided to take a technology-neutral regulatory approach, which means that if a certain product will have features of a financial instrument (e.g. securities), it will apply relevant regulation and supervision regardless of the technology used in its creation. Given the unique nature of this product, each case will be considered individually, while taking into account the substance over the form.