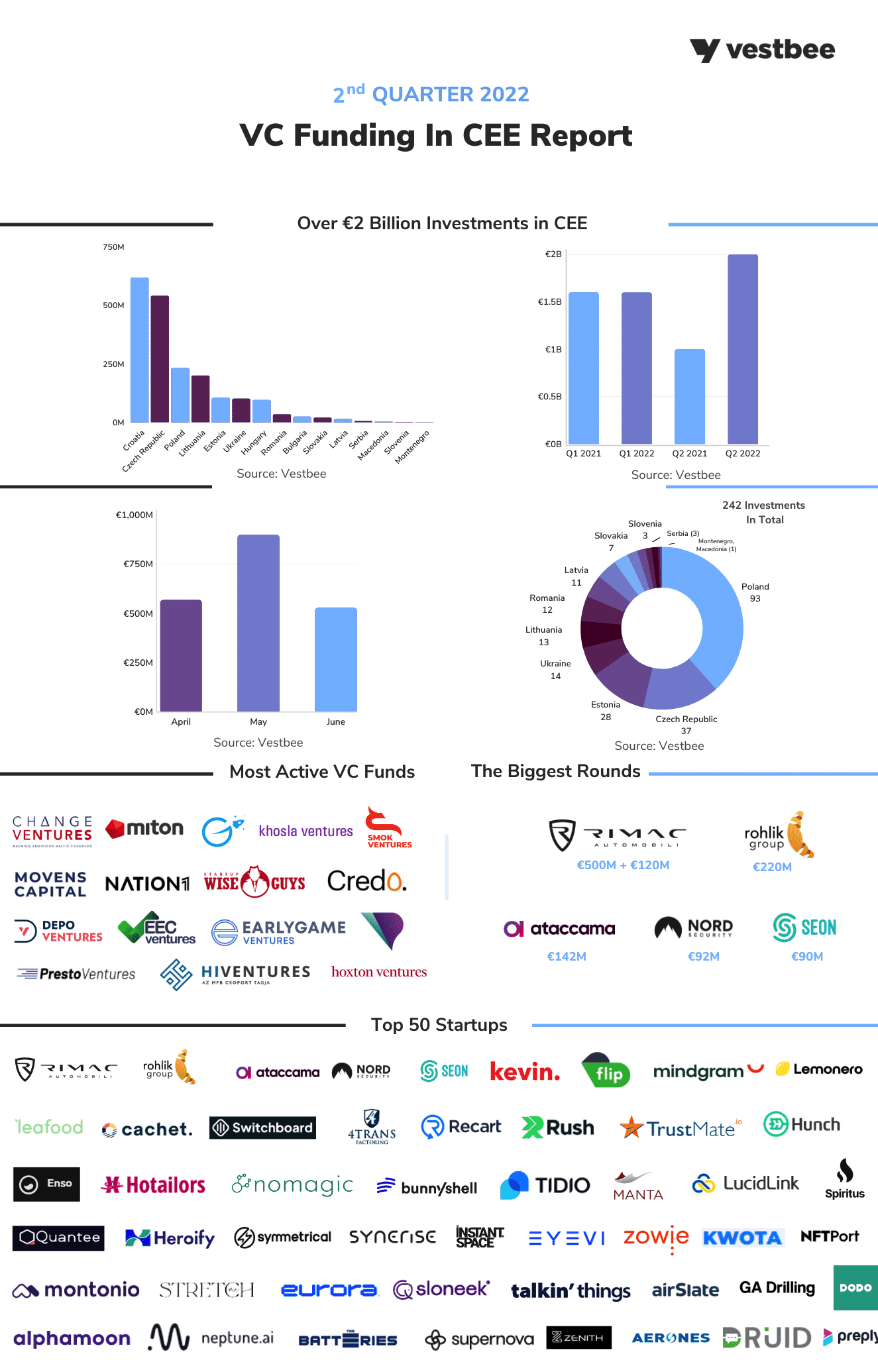

Q2 2022 was a fructuous quarter for technology startups in Central and Eastern Europe (CEE), which closed more than EUR 2 billion in disclosed funding, a figure that’s double what was raised by CEE tech startups in the same quarter last year, a new report by Vestbee, a fundraising and deal flow platform for CEE startups, shows.

In Q2 2022, fintech was one of investors’ favored sectors, accounting for 20% of the region’s 50 largest rounds of funding closed during the period. This indicates that investors are remaining bullish on the prospect of financial innovation in the region and are actively supporting young CEE fintech startups in their growth and global ambitions. Of the top 50 startup funding rounds of Q2 2022, the ten fintech deals recorded by Vestbee are:

- Seon, an Hungarian-UK anti-fraud platform which closed a EUR 90 million Series B in April to expand its presence in North America, Latin America (LatAm) and Asia-Pacific (APAC);

- Kevin., a Lithuanian payment infrastructure for online and physical sales that raised over EUR 61 million in a Series A round of financing in May just six months after securing US$10 million in seed;

- Zenith Chain, a Lithuania-based blockchain technology company that secured investment funding deal worth US$35 million in April;

- NFTPort, an Estonian startup building a non-fungible token (NFT) infrastructure for developers, which closed a EUR 24.9 million Series A in June to bring its protocol to market and help fuel the development of its infrastructure;

- Symmetrical.ai, a Polish-UK payroll provider, which raised US$18.5 million in financing in April to support its expansion into new European markets and enterprise clients, and grow its team;

- Lemonero, a Czech startup that provides an artificial intelligence (AI)-driven lending tool for small and medium-sized online businesses, which closed EUR 12 million in a seed round in June to expand across Europe, starting with France and the Netherlands, and later, Germany, Austria and Switzerland, also referred to as the DACH region;

- Montonio, an e-commerce checkout solution from Estonia, that raised EUR 11 million in a Series A funding round in April to expand to Poland and other markets;

- Cachet, an Estonian insurtech startup providing solutions for the platform economy workforce, which closed EUR 5.5 million in a Series A round in May to expand its services across Europe, grow its team, and improve its technology and data models;

- 4Trans Factoring, a supply chain and logistics invoice factoring specialist from the Czech Republic, that secured EUR 18 million in equity and debt funding in June to strengthen operations domestically, develop its platform further and grow its international team; and

- Quantee, a Polish startup providing a software-as-a-service (SaaS) platform for AI-based insurance pricing, which raised EUR 650,000 in a seed funding round in May to further develop its software and expand to the UK and Spain.

Q2 2022 VC funding in CEE, Source: Vestbee

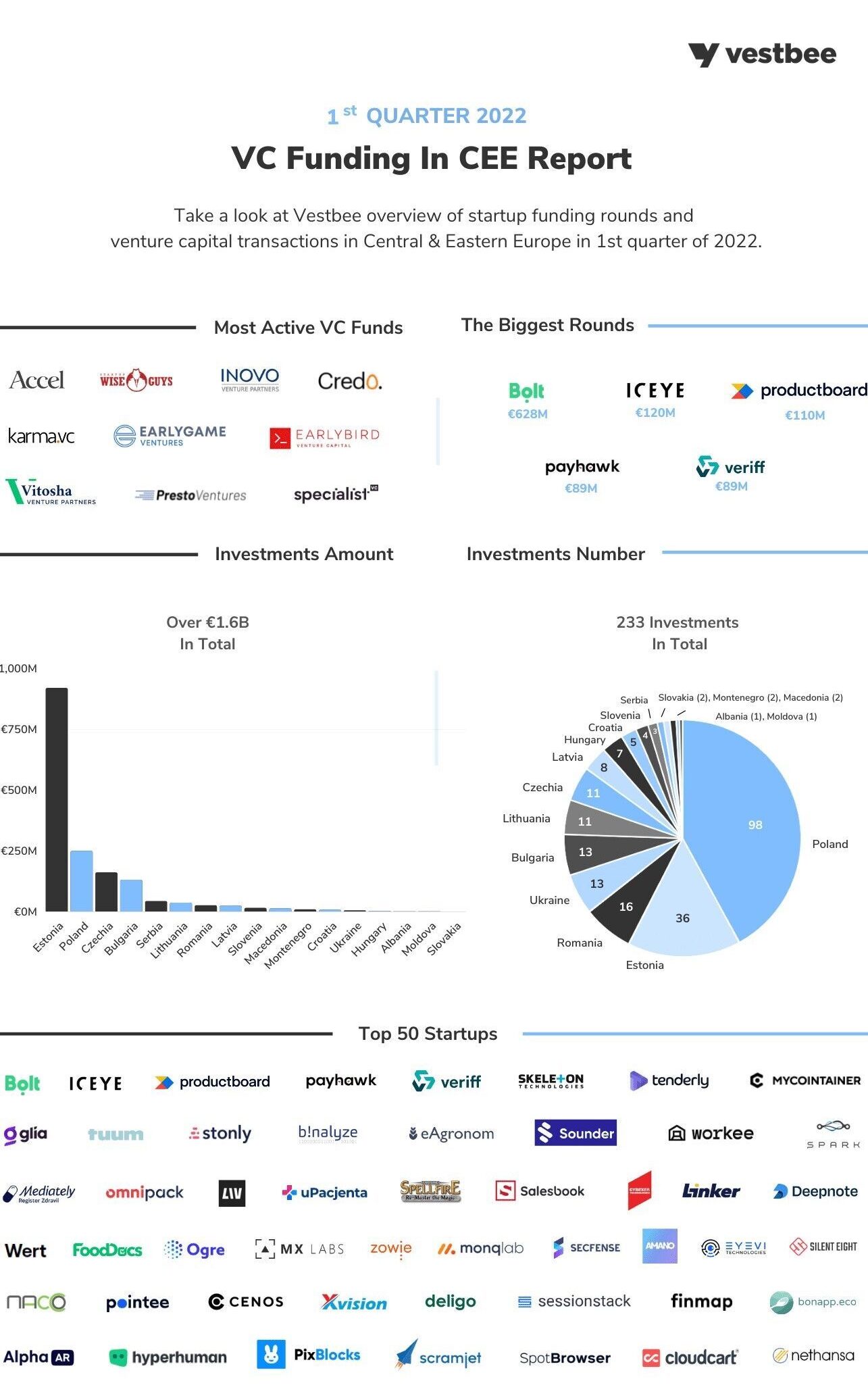

These deals build on a dynamic first quarter of 2022 during which eight fintech startups made it into the top 50 largest deals ranking. Notable fintech funding rounds in Q1 2022 included Payhawk’s US$100 million Series B extension (Bulgaria/UK), Veriff’s US$100 million Series C (Estonia), Tenderly’s US$40 million Series B (Serbia), Tuum’s EUR 12 million Series A (Estonia), MyCointainer’s US$6 million seed round (Estonia) and Wert’s US$5 million seed round (Estonia).

Q1 2022 VC funding in CEE, Source: Vestbee

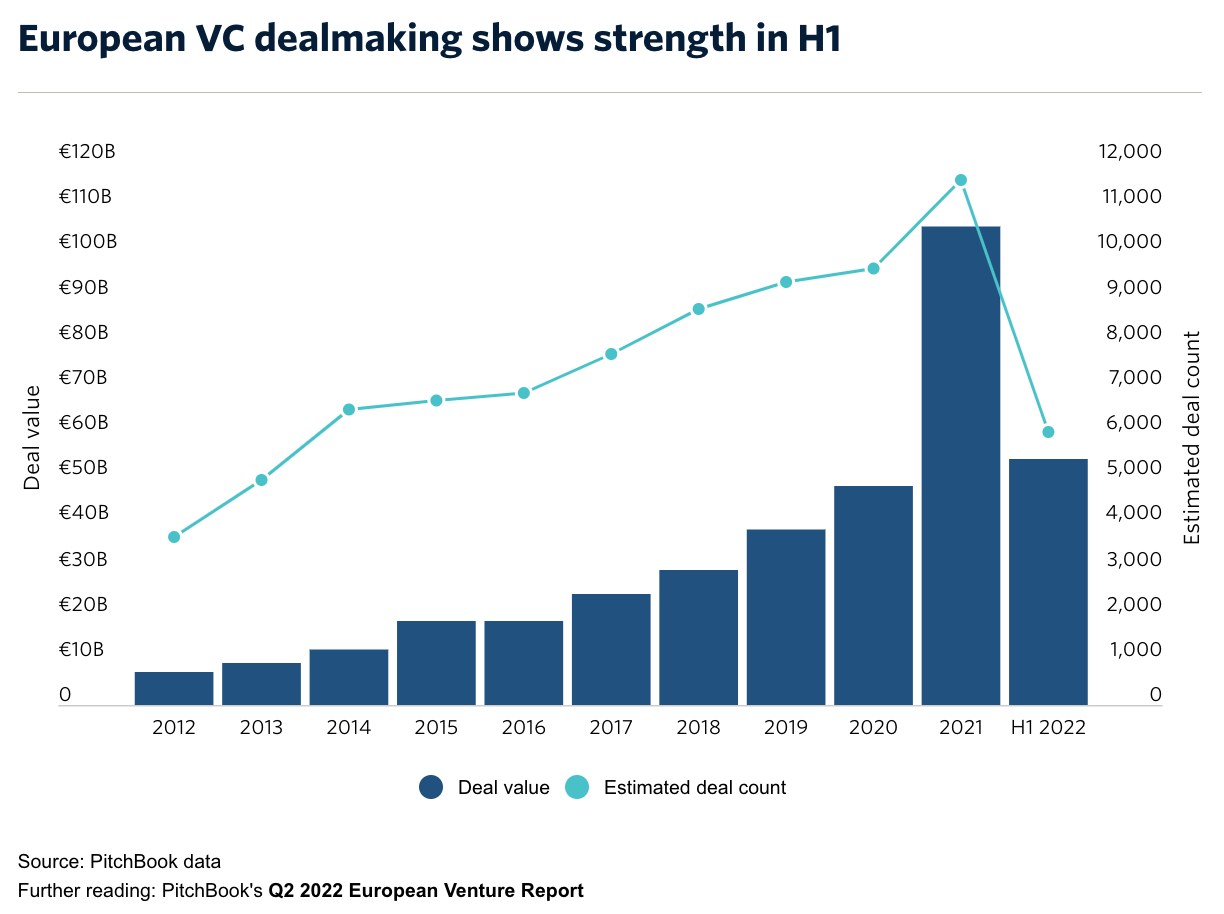

Data from Vestbee suggest that 2022 has so far been a successful year for CEE tech startups. During the first half of the year, a total of EUR 3.6 billion was raised by startups in the region, representing a 80% increase compared to H1 2021 (EUR 2 billion). Poland, Estonia and the Czech Republic led the region’s startup funding activity in H1 2022, securing a total of approximately EUR 500 million, EUR 1 billion and EUR 700 million, respectively, according to Vestbee. Poland saw 191 deals, Estonia, 64, and the Czech Republic, 48. Despite falling tech stocks and concerns about an economic downturn, European VC dealmaking kept up momentum from 2021 during the first half of the year. European tech startups raised a total of EUR 54.4 billion across 6,044 deals in H1 2022, representing year-over-year growth of 3.7% and 1.1%, respectively, data from Pitchbook show.

European VC dealmaking in H1 2022, Source: Pitchbook

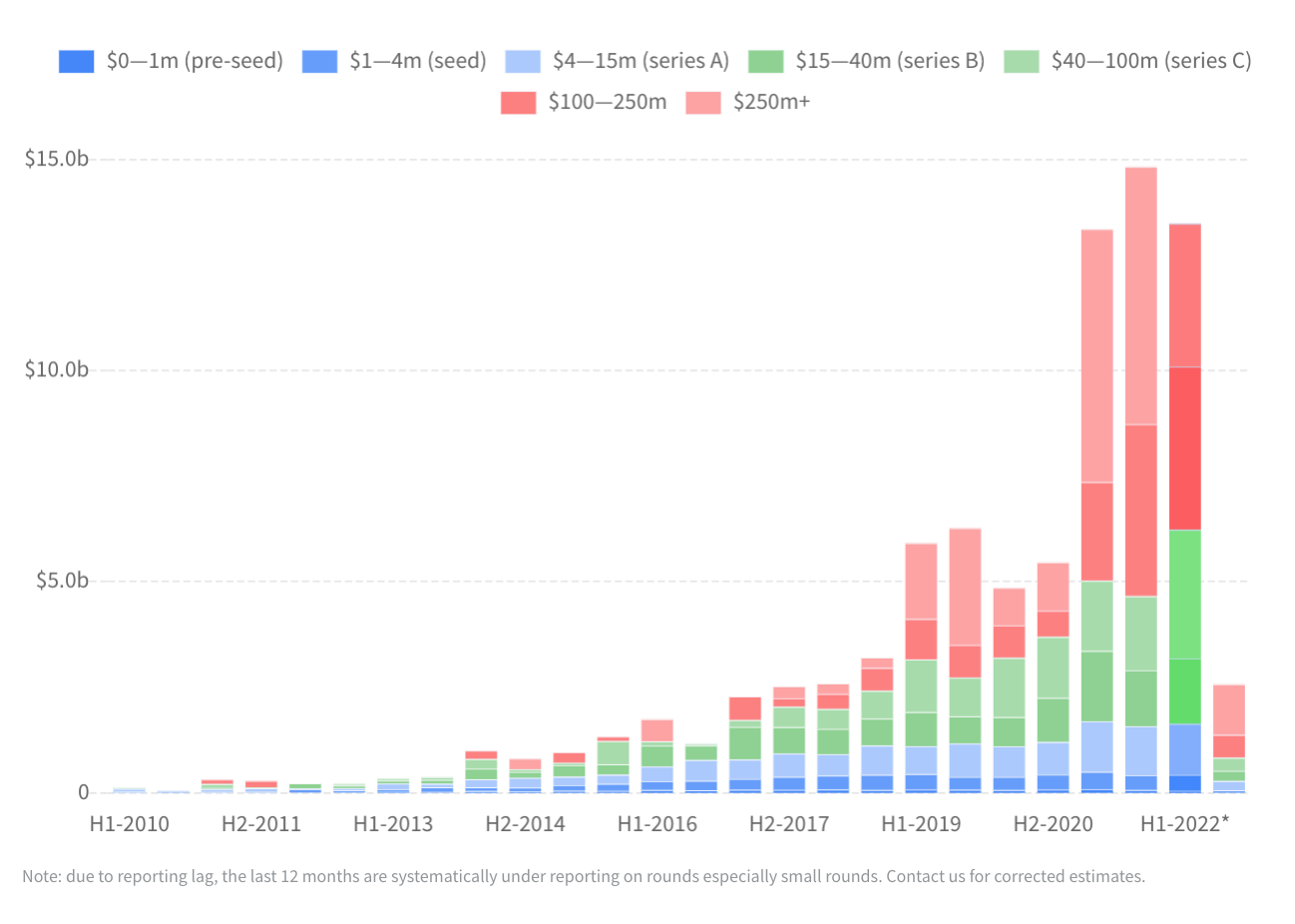

Data from Dealroom indicate that fintech companies in Europe raised a total of US$13.5 billion in H1 2022, surpassing H1 2021’s total of US$13.4 billion.

European fintech funding, Source: Dealroom

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.