Fintech Infographic of the Week: Denmark’s Fintech Startup Scene

by Fintechnews Baltic July 29, 2019In recent years, the Danish fintech sector has experienced significant growth, facilitated by a highly educated and digitally literate population, the support of specific government policies aimed at promoting financial innovation, and the development of Copenhagen as an international fintech hub.

The Danish ecosystem has evolved massively over the last three years and the entrepreneurs that started their ventures within this timeframe are now seizing global markets or building solutions with large financial corporations.

Last year, Denmark welcomed its first fintech unicorn when Tradeshift, a cloud-based business network and platform for supply chain payments, closed a 250 million Danish kroner (US$37 million) round that brought the company’s valuation at US$1.1 billion. Tradeshift serves more than 1.5 million companies across 190 countries.

Startups have shifted from being disruptors to partners with several partnerships between fintechs and banks being announced over the last few years, reflecting on the current trend of fintechs rapidly emerging as enablers. Such partnerships include Danske Bank joining the Mastercard/NFT Ventures Lighthouse Development Program and partnering with Swedish fintech Minna Technologies, as well as the collaboration between neo bank Lunar Way and Nykredit Bank.

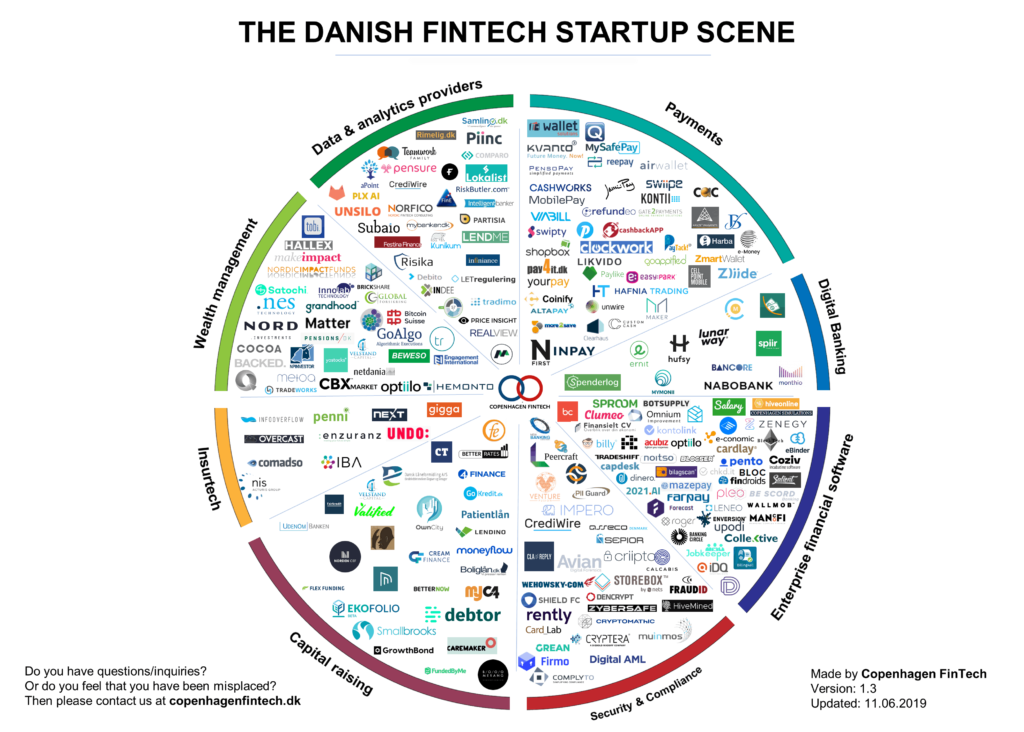

For our Fintech Infographic of the Week series, we look today at a visual from Copenhagen Fintech, a non-profit organization, that showcases the Danish Fintech Startup Scene.

Denmark’s fintech startups

The Danish fintech startup scene is diverse with a wide palette of fintech sub-sectors and digital startup businesses.

The largest group of fintech businesses in Denmark operates within the sector of digital payment solutions with mobile payments currently at the forefront. The dominant solution in this area is Danske Bank’s MobilePay, one of the most downloaded Danish apps, recording some 4.1 million users and accepted by over 100,000 businesses. But the mobile payment method is facing increasing competition from other digital payment solutions developed by local players such as MyMonii and the Dankort app, but also tech giants such as Apple, Google and Samsung.

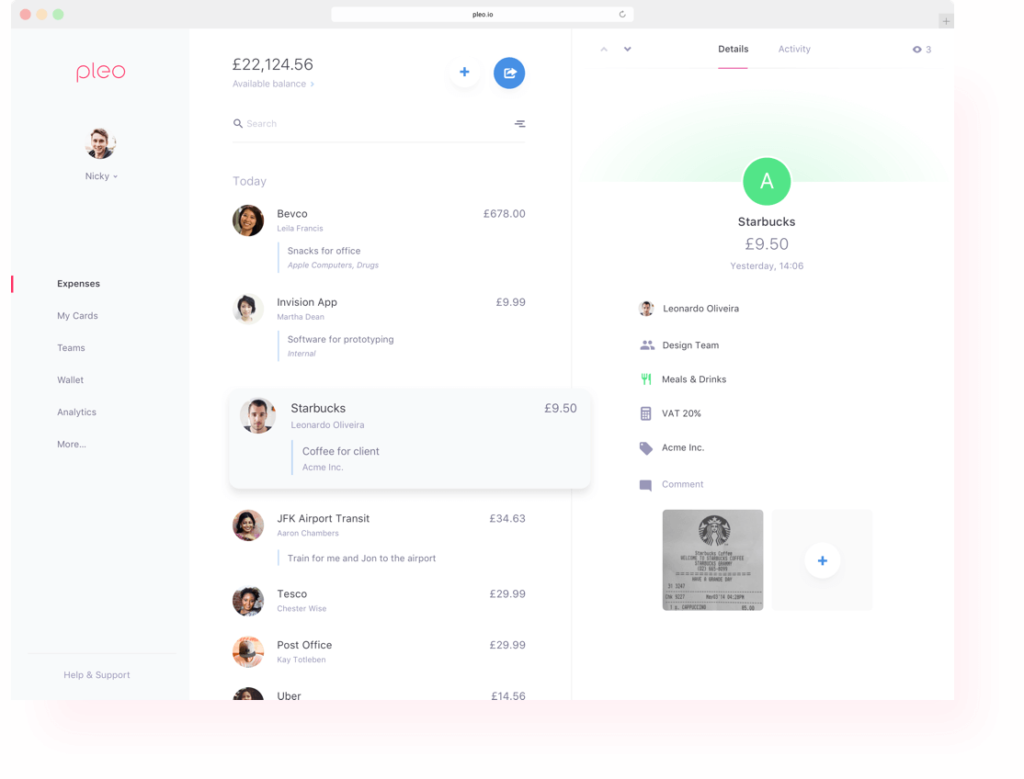

One startup in the payments/enterprise financial software segment that’s gained notable traction is Pleo. Pleo offers a complete out-of-the-box business spending solution, and provides companies with payment cards that can be easily assigned to employees, with individually set limits.

Pleo’s “smart cards” are linked to software and mobile apps. The system automatically matches receipts and tracks all the company’s spending in real-time with detailed analytics.

More than 3,500 companies use Pleo across Denmark, the UK, Germany and Sweden, and the startup was named one of 2018’s top fintechs by KPMG. In May 2019, it raised EUR 50 million in a Series B funding round.

Clearhaus, a company launched in 2015, is another payment startup. The company provides card payment solutions to online merchants and has been one of the fastest-growing fintech startups in Denmark, securing 20-25% of the domestic market within its first three years of operation. Clearhaus serves more than 7,500 merchants in over 33 countries across Europe.

Clearhaus, a company launched in 2015, is another payment startup. The company provides card payment solutions to online merchants and has been one of the fastest-growing fintech startups in Denmark, securing 20-25% of the domestic market within its first three years of operation. Clearhaus serves more than 7,500 merchants in over 33 countries across Europe.

In the insurtech segment, one notable startup from Denmark is Undo. Undo provides a mobile app for selling insurance products to millennials. It raised US$4.1 million in 2018 from Danish insurance firm Tryg.

Danish fintech startup Spiir, the company behind the eponymous personal finance management app and the Nordic API Gateway, secured EUR 5.2 million in funding December 2018.

Other noteworthy Danish fintech startups include Coinify, a cryptocurrency startup incorporated in 2014 and backed by SEB Venture Capital, Nordic Eye Venture Capital, SEED Capital Denmark, and Accelerace, that offers an array of crypto-focused solutions including a trading platform and merchant solutions, Lunar Way, a digital banking platform targeted at millennials which recently expanded to Norway, and Hufsy, a banking service for startups and entrepreneurs.

Infographic: The Danish Fintech Startup Scene,

This article first appeared on fintechnews.ch