With 19 insurtech startups, Sweden is the biggest insurtech market in the Nordics, hosting 60% of all of the region’s insurtech companies, a report by Sollers Consulting, an international operational advisory and software integrator, reveals.

The Nordic Insurtech Report, released on September 28, 2022, looks at the insurtech landscape in Sweden, Finland, Norway and Denmark, examining the different startups in the ecosystem, their business models and value propositions.

The study identified 31 insurtech startups across the region, with Sweden taking the lion’s share in terms of company country, followed by Finland with five insurtech companies, Denmark with four, and Norway with three.

Insurtech companies in the Nordic region by country, Source: Nordic Insurtech Report, Sollers Consulting, Sep 2022

Sweden is not only has the largest insurtech industry for the group, findings from the research show, it’s also the most mature one. Several homegrown players have secured significant funding and have started pursuing global opportunities.

One particular example is Bima, a provider of mobile-delivered insurance and health services that’s active in Ghana, Tanzania, Bangladesh, Cambodia, Indonesia, Malaysia, Pakistan, the Philippines and Sri Lanka. Bima is the most well-funded insurtech startup in the region, having secured a total of US$130 million in funding, the report notes.

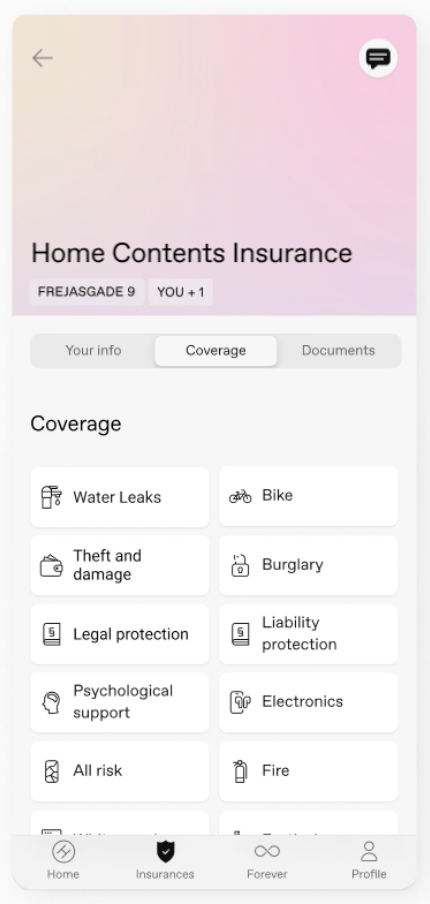

Others, like Hedvig, a company that sells home and property insurance via a digital platform, have expanded to neighboring Nordic countries, while companies like Omocom, which specializes in digital and embedded insurance products, have launched in other European countries.

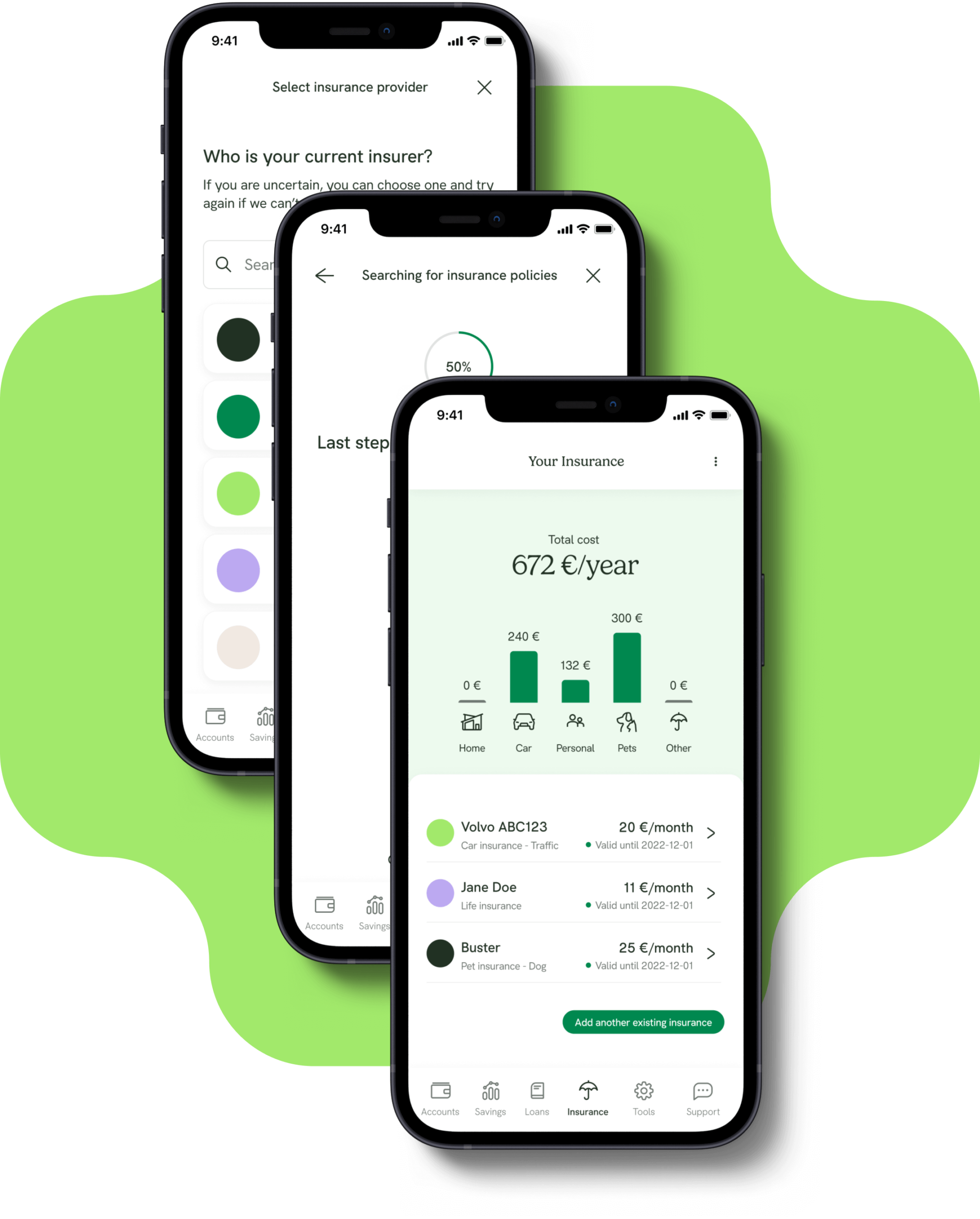

Hedvig app, Source: Hedvig.com

An analysis of Nordic insurtech startups’ revenues reveals that while earnings are still relatively modest, with Swedish companies reporting revenues between US$400,000 and US$1.6 million, these companies are growing steadily, with startups reporting revenue increases between 30% and 40% annually.

Looking at Nordic insurtech companies’ business models, the analysis found that these companies mainly focus on private customers, with 38% of the companies studied operating under a business-to-consumer (B2C) model.

Nordic insurtech startups provide customers with advanced, comprehensive and digital solutions covering home insurance, telematic-based motor insurance and pet insurance, the report notes, and strive to delight them with superior customer experiences enabled by business partnerships and automation. Many of them are offering unique value propositions that are not available anywhere else on the market.

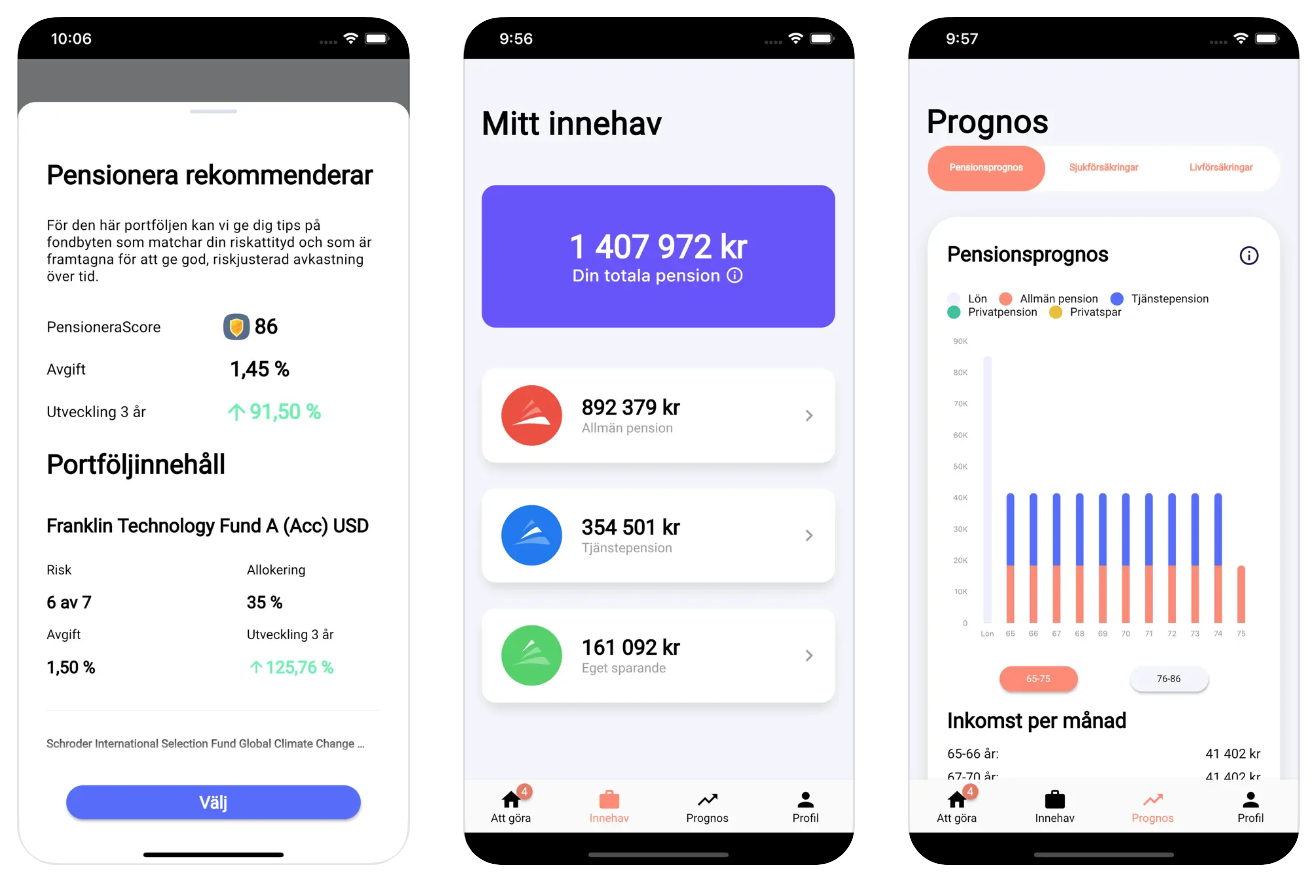

Stockholm-based startup Pensionera, for example, has created a solution for digital pension advice; Norwegian insurtech company Safetywing provides health insurance for expats; and Sweden’s Bima distributes life and health insurance sold by physical agents and managed via mobile technology in developing countries.

Pensionera iOS app, Source: Apple App Store

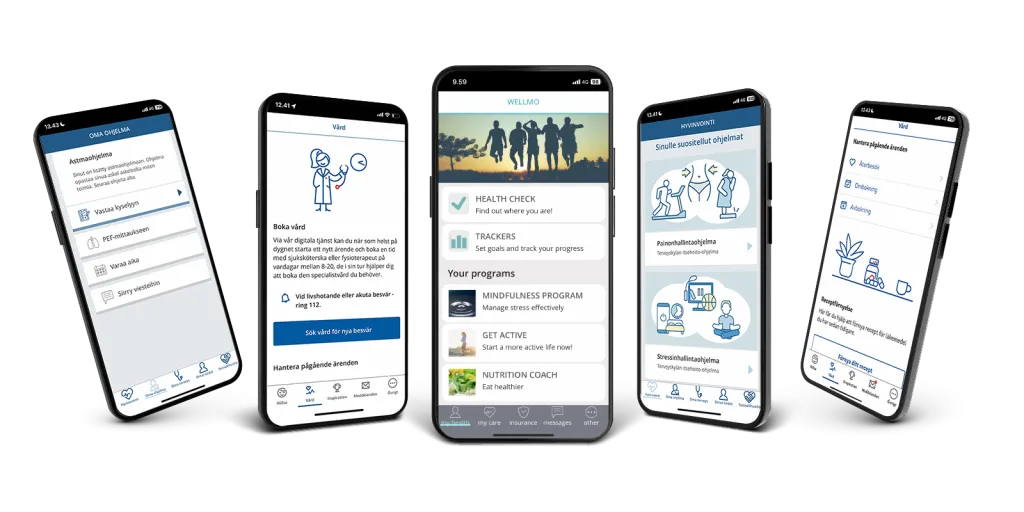

Besides B2C insurtech companies, the Nordic region is also home to a number of startup that are supporting market leaders with innovative, digital offerings. These companies, which make up for 38% of all Nordic insurtech startups, operate under a business-to-business-to-consumer (B2B2C) model and seek out partnerships with insurance firms, e-commerce providers and other digital intermediaries.

Examples of Nordic B2B2C insurtech startups include Wellmo, a Finnish company that offers a digital health platform that measures and analyses health-related activities; EIR Forsakring, a digital white label insurance platform provider from Sweden; and Easy Peasy Insurance, an embedded insurance specialist from Sweden.

Wellmo app, Source: Wellmo.com

Finally, 31% of Nordic insurtech startups operate under a business-to-business (B2B) model and focus on providing insurance firms and e-commerce companies with automation tools, core systems and new business opportunities.

These companies include Redkik, a Finnish startup providing artificial intelligence (AI)-based cargo insurance solutions that cooperates with US insurers such as Roanoke Insurance, Howden and Chubb; Insurely, a Swedish open insurance solutions provider that serves insurance firms and banks including Nordnet, Avanza, and Soderberg and Partners; and Insicon, a Swedish provider of an all-in-one insurance system supporting automation and digital transformation.

Insurely insurance manager, Source: Insurely.com

This article first appeared on fintechnordics.com

Featured image credit: edited from Freepik

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.