Ukrsibbank Rolls Out Swedish Startup Dreams’ Financial Wellbeing Platform

by Fintechnews Baltic June 9, 2021Dreams, a Swedish provider of behavioural and engagement banking solutions, announced the launch of its financial wellbeing platform in partnership with Ukrainian commercial bank UKRSIBBANK BNP Paribas Group.

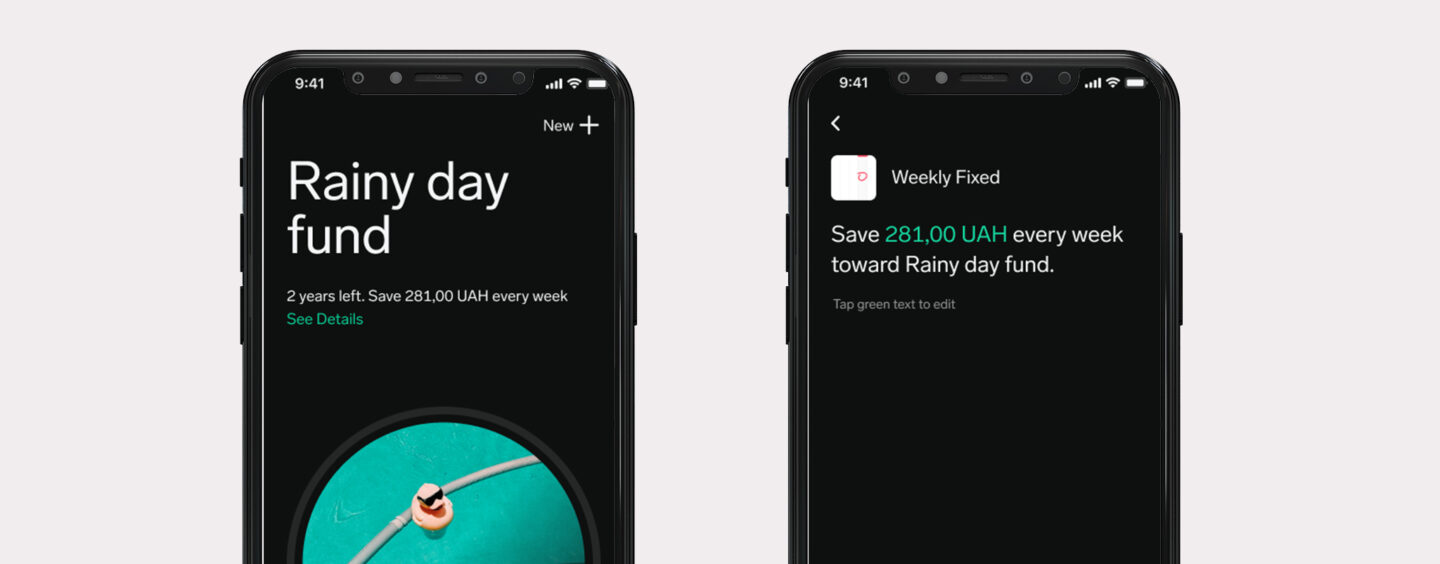

The company’s financial wellbeing platform is now embedded into UKRSIBBANK’s mobile banking app, giving its 2 million customers across Ukraine access to a full range of additional functionalities from which they can set and achieve money-saving goals through clever, automated saving features, in addition to nudges and hacks.

The integration will help UKRSIBBANK to revamp its digital banking offering with a more personalised and engaging user experience, which will drive customer satisfaction by boosting the financial wellbeing of its customers, and help to attract new audiences.

The Dreams platform will also provide UKRSIBBANK with additional revenue streams and growth opportunities, by encouraging users to boost their personal savings and thus enabling the bank to significantly increase its savings under management.

Henrik Rosvall

Henrik Rosvall, CEO and Co-Founder of Dreams said,

“We’re delighted to be launching our product in Ukraine and to be helping millions of more people make better financial choices and feel better about their money.

With Ukraine’s large population of digitally savvy millennials, eager to engage with their digital bank, we’re confident that our financial wellbeing platform is the perfect fit to help UKRSIBBANK build long-lasting loyalty to its brand, cater to the needs of new audiences and lead the way in terms of engagement banking.”

Konstantin Lezhnin

Konstantin Lezhnin, Head of Retail and SME at UKRSIBBANK BNP Paribas Group said,

“This partnership with Dreams marks a really important step in our mission of guiding our customers towards responsible consumption and sustainable personal finance management.

Beyond providing our customers with a rich user experience enabling them to better understand and improve their financial wellbeing, the Dreams platform will allow us to create new dimensions of customer engagement and drive additional revenue and growth opportunities.”

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.