2020 Baltic Startup Scene Report Names 11 Fast-Growing, Promising Fintech Startups

by Fintechnews Baltic December 21, 2020Startup Wise Guys and EIT Digital have released their annual Baltic Startup Scene report, outlining the state of the Baltic startup ecosystem and the progress made over the past year.

Amid COVID-19, the Baltics’ fintech sector saw a particular increase in the number of startups dealing with lending and debt, wealth management, insurtech, regtech and small and midsize business (SMB) finance, the research found.

The year also saw the emergence of startups focusing on sustainable finance as well as finance for specific societal subsections, including the aging population, kids and unbanked individuals.

One notable trend in 2020 was embedded fintech where financial services, rather than being offered as standalone products, are part of the native user interface of other products, becoming thus embedded. This is making it increasingly difficult to differentiate between pure fintech players versus software companies with financial consumer products and features.

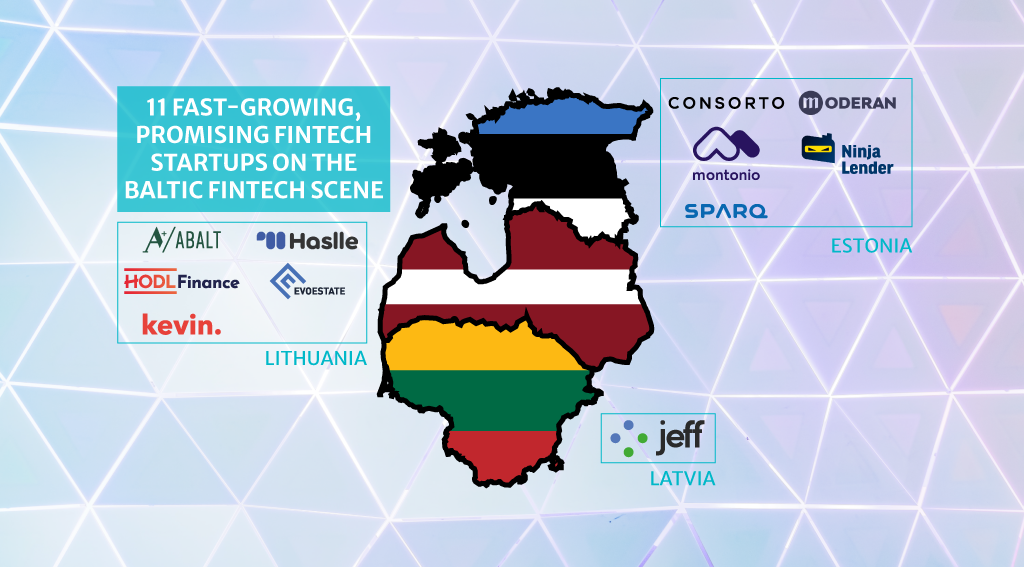

11 Baltic fintech startups to watch closely

As part of the study, the 2019/2020 Baltic Startup Scene report cites fast-growing, promising fintech startups from the region that have made notable strides over the past years and which are poised to take off.

Most of these startups come from Lithuania, showcasing that the country has managed to establish an attractive environment for fintech startups to thrive.

The “On the radar” category comprises 11 fintech startups that have already made a mark in the market and ecosystem, have raised between EUR 100,000 and 1 million, launched their product, attracted paying customers, and have moved outside of their home market.

These fintech startups, among which 5 from Lithuania, 5 from Estonia and one from Latvia, are:

- Okredo (formerly known as Abalt) (Lithuania), an open data platform that enables businesses to uncover potential and risks providing free credit scores and insights;

- Haslle (Lithuania), a business spending management tool;

- Hodl Finance (Lithuania), a digital lending company that issues loans backed by cryptocurrency and other digital assets;

- Evoestate (Lithuania), a real estate crowdfunding aggregator providing cross-border investment opportunities from over 15 platforms;

- Kevin. (Lithuania), a licensed payment institution focusing on solutions based on PSD2 directive with a vision to becoming a connection between banks, customers and fintechs;

- Consorto (Estonia), a technology company that connects professional investors to commercial real estate investment opportunities across Europe;

- Moderan (Estonia), a lease and commercial property management software;

- Montonio (Estonia), a point of sales financing solution that allows online shoppers to compare different installment offers;

- Ninja Lender (Estonia), a business-to-business (B2B) marketplace for credit institutions to buy and sell rejected loans;

- Sparq (Estonia), a community-based personal finance platform; and

- Jeff App (Latvia), a credit broker that connects borrowers with the best loan offers available to them.

- The report also names six smaller, early-stage startups which might not have had significant traction yet but which are showing great potential.

These six “Hidden treasures,” among which three from Lithuania, two from Latvia and one from Estonia, have raised less than EUR 100,000 in funding, launched in their home markets, but are lacking visibility in the market and ecosystem.

These fintech startups are:

- Heavy Finance (Lithuania), a crowdfunding platform for investors to invest in loans for heavy machinery;

- Ooniq (Lithuania), a peer-to-peer (P2P) insurance platform;

- Properenty (Lithuania), a platform helping landlords manage property rent business;

- Flipful (Latvia), a tool that enables companies to provide their employees a flexible salary payout at any time before payday;

- Vialet (Latvia), a financial service management tool; and

- ForPeeps (Estonia), an all-in-one mobile banking app.

The Baltic startup scene in 2020

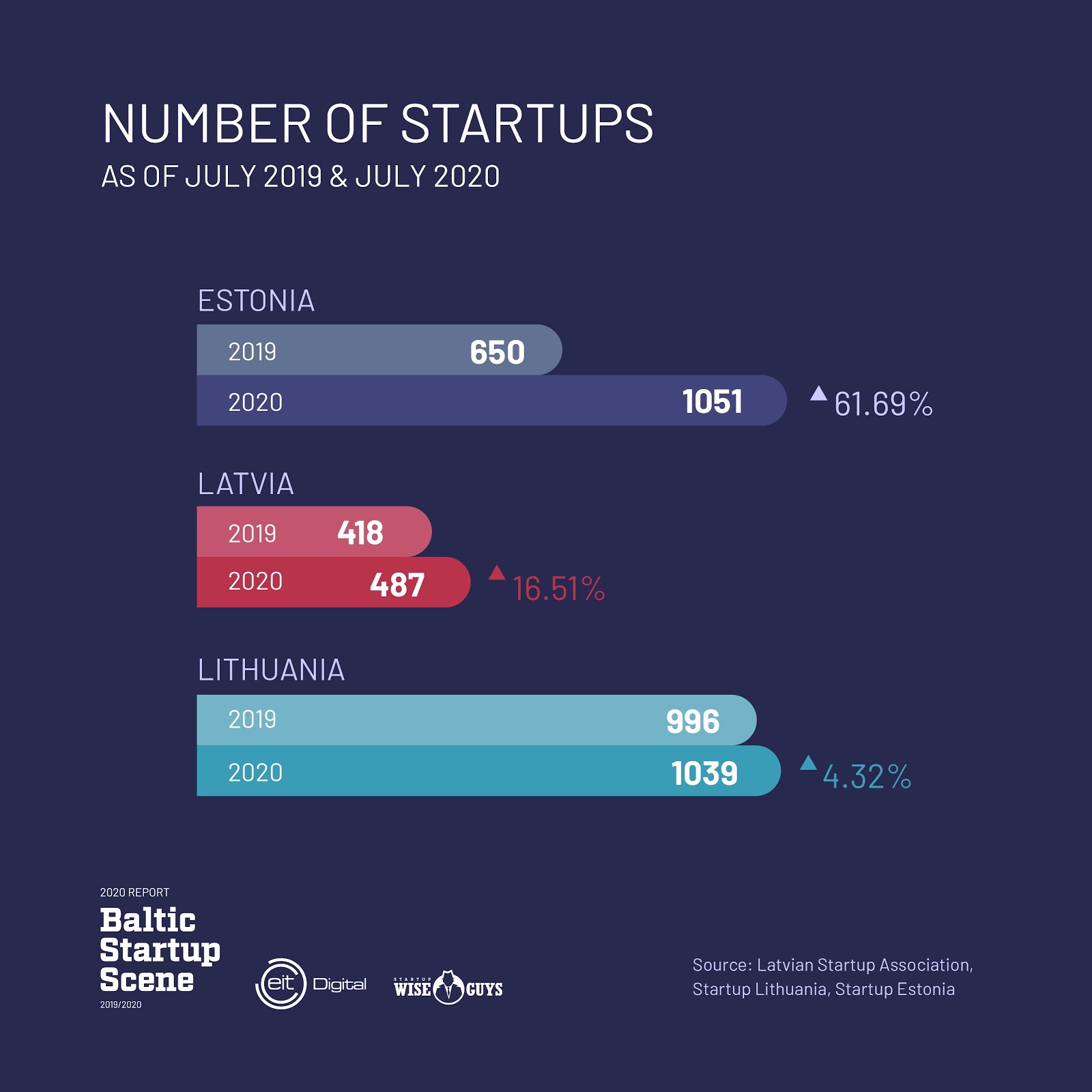

Despite COVID-19, the Baltics startup ecosystem continued to grow in 2020. As of July 2020, Estonia was home to 1,051, up 38.15% from the previous year. Latvia saw an increase of 14.17% in the number of startups to 487. Growth was slower for Lithuania at 4.14% to 1,039 startups.

Number of startups in the Baltics as of July 2019 and July 2020, 2020 Baltic Startup Scene, Startup Wise Guys and EIT Digital, Dec 2020

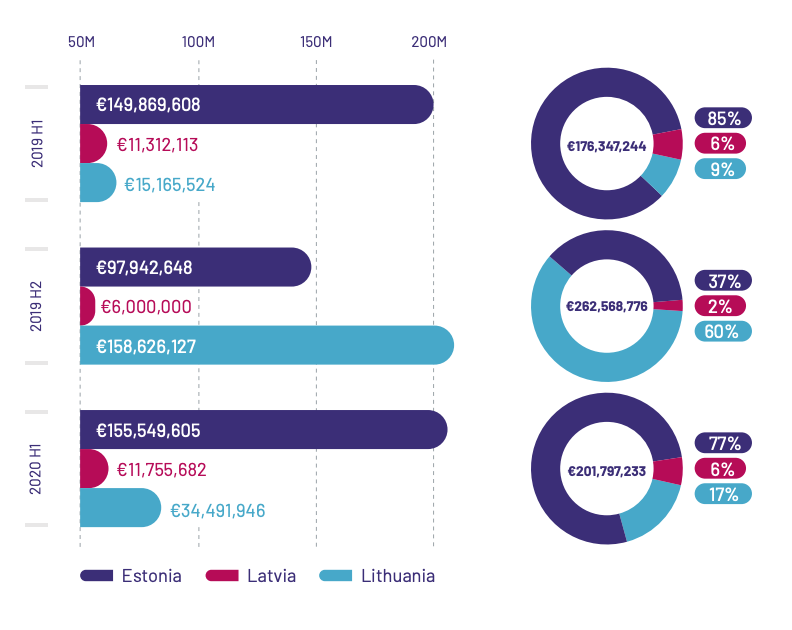

Funding remained consistent this year, with H1 2020 amount (EUR 201 million) even outperforming H1 2019 (EUR 176 million).

In H1 2020, Estonia attracted most of the region’s startup funding (77%), followed by Lithuania (17%) and then Latvia (6%).

Share of startup funding per country, 2020 Baltic Startup Scene, Startup Wise Guys and EIT Digital, Dec 2020

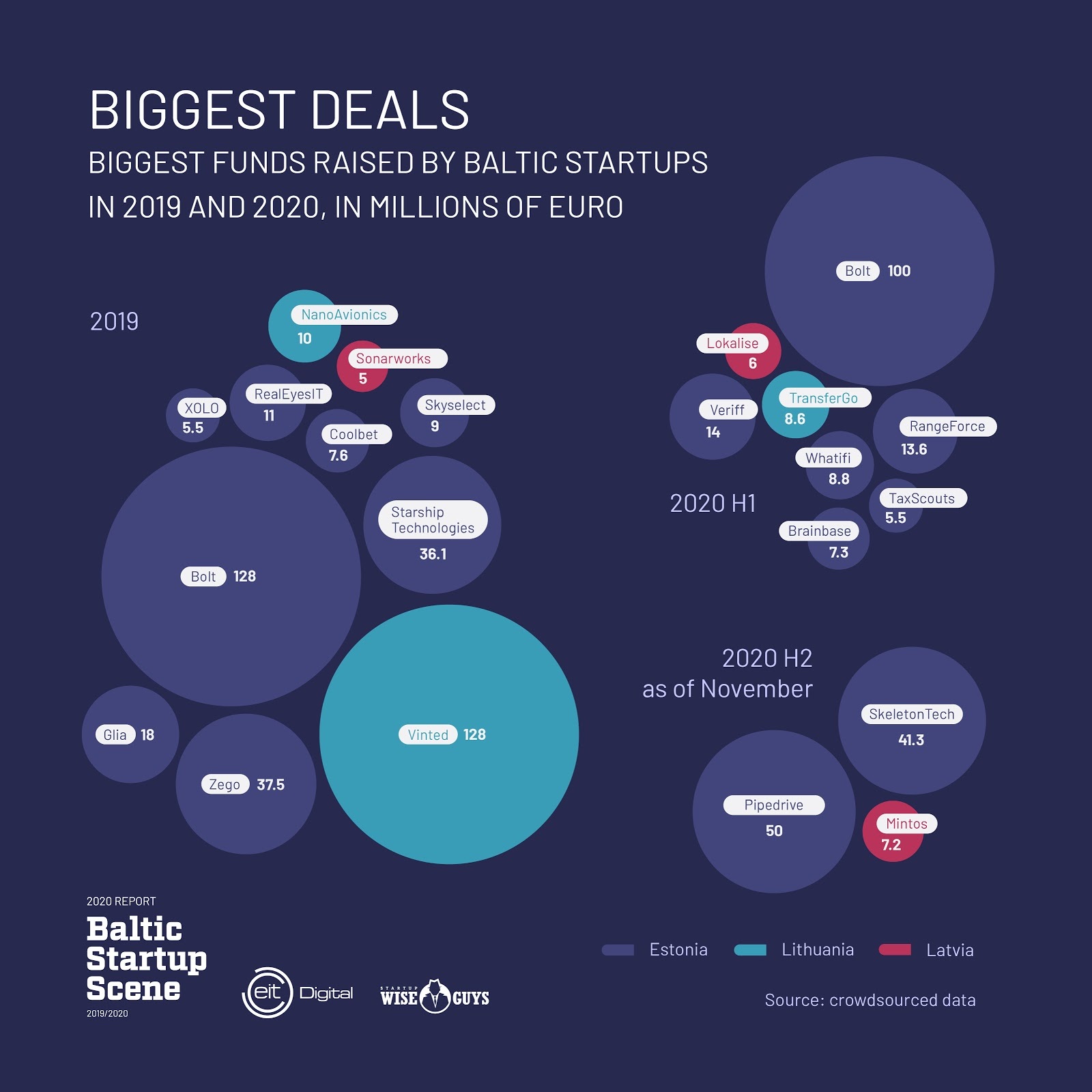

2020’s biggest fintech deals included TranferGo (EUR 8.8 million), Mintos (EUR 7.2 million) and TaxScouts (EUR 5.5 million).

Biggest funds raised by Baltic startups in 2019 and 2020 in millions of euro, 2020 Baltic Startup Scene, Startup Wise Guys and EIT Digital, Dec 2020

1 Comment so far

Jump into a conversation