Bank of Lithuania in Final Sandbox Testing with IBM and Tieto for LBChain

by Company Announcement October 22, 2019The Bank of Lithuania has chosen IBM Polska and Tieto Lietuva, UAB to proceed to the next stage of its endeavour to create LBChain, a blockchain-based technological platform. The winner of the project will be revealed after the final testing session, which is to begin soon.

To this end, the Bank of Lithuania issued an open call for fintechs and startups to register their interest in participating in the testing phase.

Andrius Adamonis

“The final testing session will show which solution is most suitable for market needs. We believe that the greatest advantage of LBChain is its versatility. We strive to create a platform that would not only serve for testing products or services that are already offered on the market, but would also be used to create those that might currently exist only in a financial architect’s mind,”

said Andrius Adamonis, LBChain Project Manager at the Bank of Lithuania.

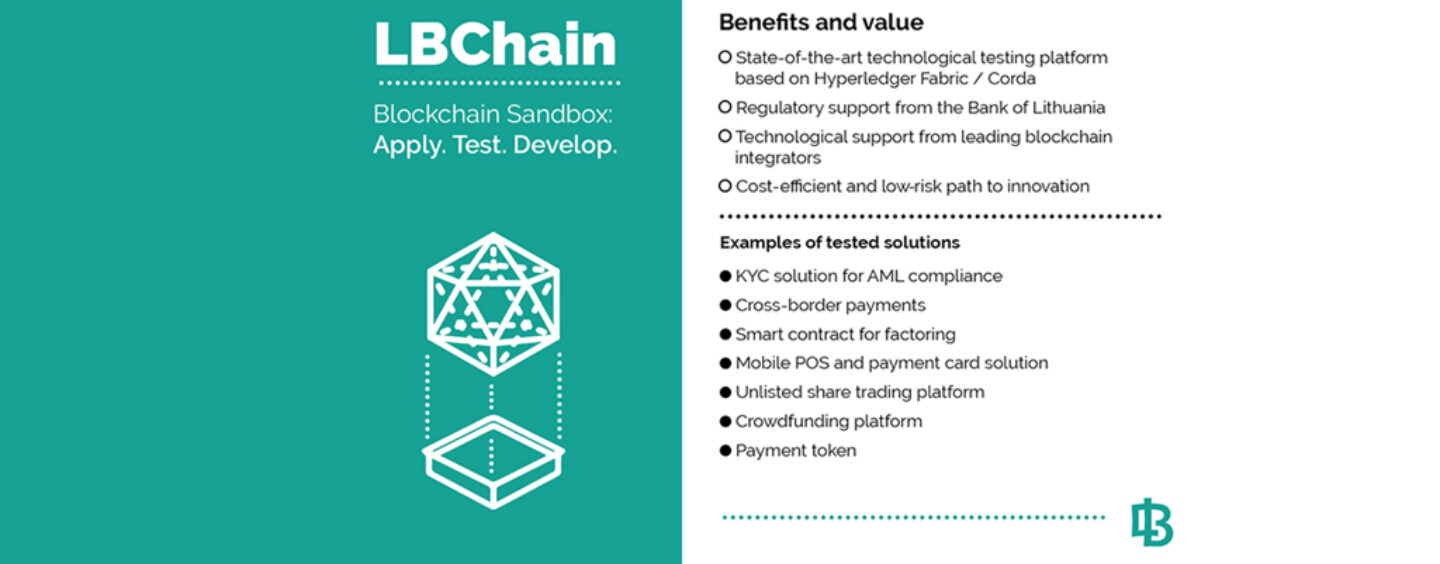

LBChain, which is both a technological platform and a regulatory sandbox, aims to solve several problems faced by financial innovators. Usually fintechs and startups have bold and innovative ideas; however, they lack general knowledge and experience when it comes to the financial ecosystem, legal issues and regulation. They also generally do not have the opportunity to test their products in a safe and innovation-conducive environment. LBChain offers both: consultations by the Bank of Lithuania on regulation as well as technical and technological assistance by leading blockchain integrators.

“It basically means that you can start your product from scratch and use LBChain to develop it into a market-ready solution,”

stated Mr Adamonis.

Based on Hyperleger Fabric and Corda, LBChain offers the possibility to test a wide range of financial products and services. Fintech companies from three European countries have already tested several products, including a KYC solution for AML compliance, cross-border payment solution, smart contract for factoring process management, payment token, mobile POS and payment card solution, crowdfunding platform and unlisted share trading platform.

Registration for participation in the LBChain project is now open.